Whole Life Insurance Plan

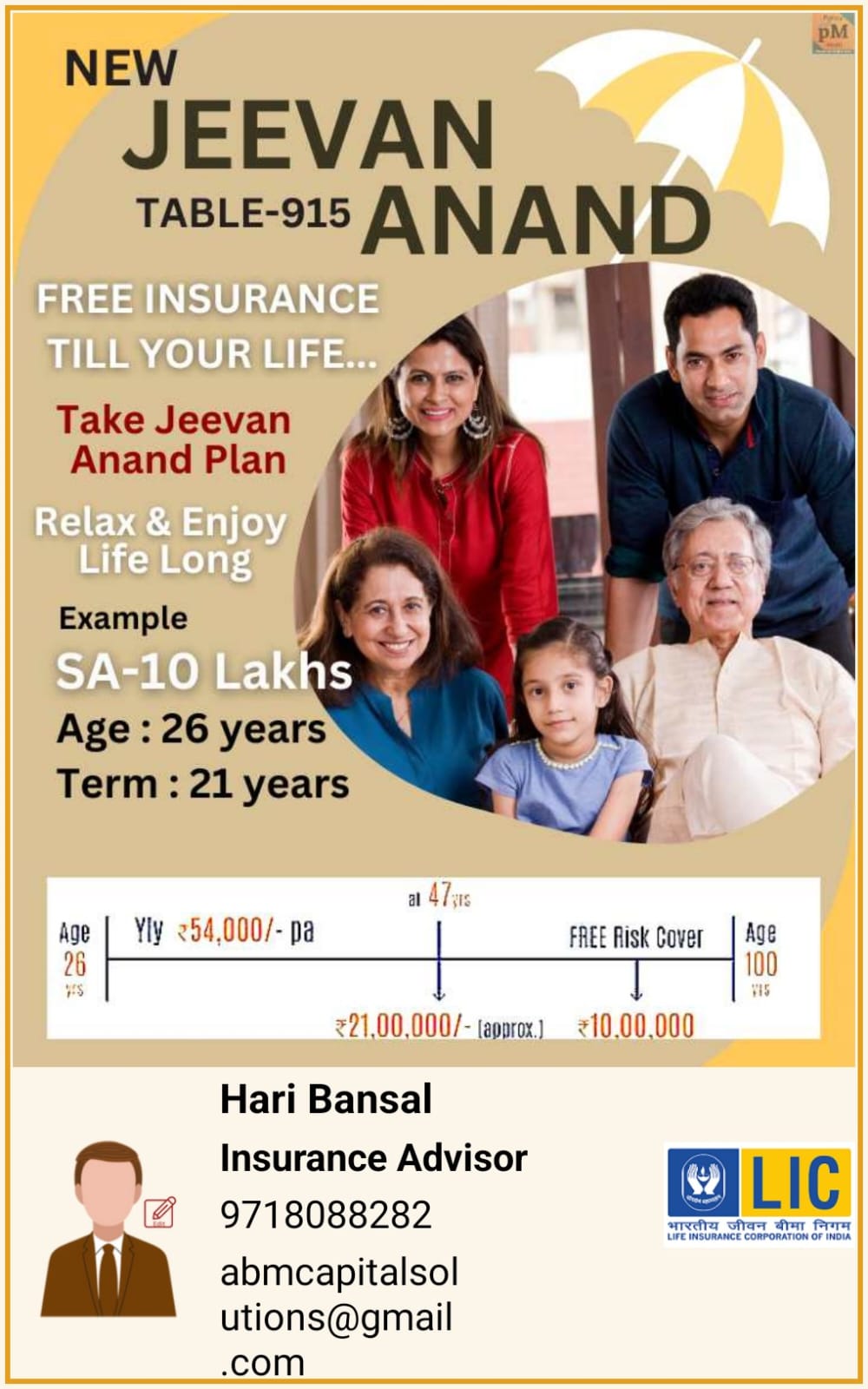

Individuals requiring long-term and permanent coverage always go with the whole life insurance plan. This insurance plan differs from the term life insurance, which is a type of temporary insurance. This is permanent life insurance that is designed to cover the insurer's rest of their life. It means the insurer secures their life as long as premiums are perfectly maintained.

Whole life insurance is also referred to as traditional life insurance offering permanent death benefit coverage for the policyholder. Apart from paying a death benefit, it comprises the savings component that accumulates the cash value. The interest is calculated at a fixed rate and on a tax-deferred basis. Moreover, it renders additional benefits that no term life policies offer the policyholders.

Types

Whole life insurance is available in the following types and thus chooses the right one suitable for your needs. Usually, this insurance plan is classified based on how premiums are priced and policy risk allocated.

- Traditional whole life insurance – It is also the basic type of insurance. The policyholder pays the fixed amount of premium that continues to add the cash value and render the coverage for the full life until the premiums are paid.

- Universal Life Insurance – Limited payment is another important policy offering the feature of adjusting the premiums and the death benefits based on the variable needs.

- Indexed – This gives the insurance holder an option to choose from various index options, where the interest is based on the stock market performance.

- Participating in whole life insurance – It gives the rights to the policyholder to receive the dividend from the insurance company’s profit.

- Joint whole life insurance – It covers 2 people usually for one death benefit. It pays when one person dies and the surviving person can receive the death benefits.

- Final expense insurance – It covers the end-of-life expenses like funerals and others.

Benefits

- The key benefit of the whole life insurance plan is that it renders you a lifetime of coverage protection. This lifelong coverage does not expire or require it to be renewed.

- The key benefit of the whole life insurance plan is that it renders you a lifetime of coverage protection. This lifelong coverage does not expire or require it to be renewed.

- Your dependents will also benefit from this policy because it offers an additional financial source for the family.

- The plan offers tax benefits, periodic payments, and assurance of coverage. These will not be available in the regular life insurance plans.

Documents Required:

Those who want to take the whole life insurance plan must check the eligibility chart of the insurance company. Upon meeting the eligibility conditions, it is better to look for the documents required. Here are the documents to submit to join the plan.

- Duly filled proposal form

- Age proof of the life assured (birth certificate, passport, and educational certificate)

- Bank account details and passport-size photographs of the policyholder and beneficiary

- Address proof (voter ID, passport, and ration card)

- Identity proof (Aadhaar card and PAN card)

What Is Not Included?

- Lifestyle-related deaths

- Suicidal deaths

- Death due to involvement in illegal activities

- Death because of drug and alcohol abuse

- Death because of involvement in life-threatening sports such as paragliding