Term Insurance

Term insurance is an agreement between the policyholder and the insurance company where the holder is demise; the specific sum is paid to the nominee assigned by the holder from the insurance company. Do you worry about what will happen to your family after your death? Don’t worry! Term insurance will safeguard your family after unforeseen situations. You will find out the significant term plans for long-term financial planning.

Of course, term insurance is pure life insurance offering financial protection to your family members after death. Based on the term insurance plan you buy, your family will get life cover or a sum assigned within the policy period.

Types

- Level term plans – It gives a fixed level of coverage for a fixed period of time. This will give the benefit if the policyholder dies during the fixed insurance period but if he outlives the period he will not get any coverage.

- Increase term insurance – It gives coverages that increase by a fixed ?ch year. The premium remains the same.

- Decrease term insurance – It gives coverage that decreases by a fixed ?ch year, remaining the premium same.

- Return of premium term insurance – It refunds all the amount of premium paid during the policy period together with the coverage amount in case the insured person outlives the policy term period.

- Convertible term plans – These give the insured person an option to convert their term insurance into a permanent life insurance policy with in a particular time period mentioned in the policy.

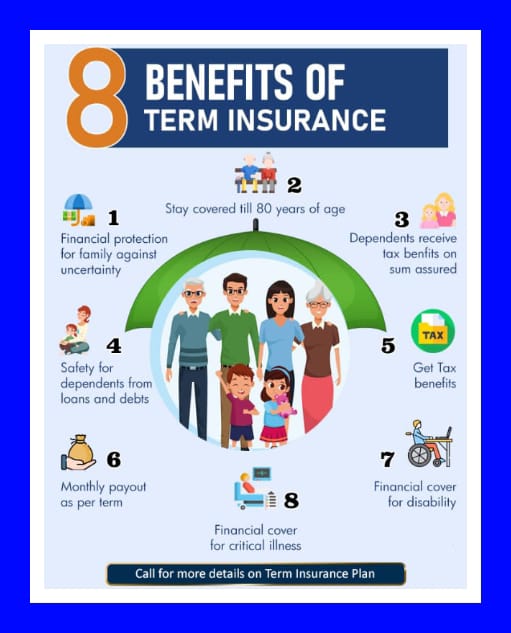

Benefits

Now, you are aware of the type of term insurance before making a decision. But at the same time, you must know the benefits of choosing the best term insurance. You must check the feature and benefits of term insurance plans in detail. So, read further to get the benefits of picking the term insurance for your family.

- Cover Against Eventualities : As a family head, you can help secure your loved ones against the term insurance plan. However, the term insurance will cover against eventualities and easily take a significant life cover policy for your family member. So, you must under the term insurance plan benefits before buying it.

- Provides Add-on Riders : You can even add riders to your term insurance plan. Of course, riders will help you expand the policy benefits by paying an additional premium. So, it gets comprehensive coverage, and riders will serve this purpose anytime.

- Provides Cover for Critical Illnesses : No one can judge what will happen the next day or in the future. If you are suffering from a critical illness, the term insurance will protect your family financially. As a result, the plan includes death benefits, and you can increase coverage with a critical illness rider.

- Cover for Accidental Death or Disability : Accidents may happen anytime anywhere. We could not expect the severity after the accidents. We may even lose our family members. To compensate for the loss of income, term insurance will help you at that time. It helps you track such situations with accidental death or disabilities.

- Offers Tax Benefits : With term insurance, you can avail of tax benefits on premiums paid under section 80C. Of course, you can avail tax benefits up to Rs.15 lakh on the premium paid so far.

- Include Multiple Payout Options: There are multiple payout options available for your family members. Once they don’t have the necessary to know about large amounts, at that time, term insurance will offer you multiple payout options.

Documents Required

- Voter ID Card

- Passport

- Aadhaar Card

- Or any other photo identity proof

- PAN Card

- Income Tax Returns (not more than two years old)

- Latest Form 16

What Is Not Included?

- Death due to drinking and drive of alcohol.

- Death due to driving under illegal drugs influenced

- Participation in hazardous activities

- Death due to participation in adventure sports

- Death due to pre-existing health conditions and childbirth