Systematic Investment Plan (SIP)

A SIP is a systematic investment plan, a popular facility offered by mutual funds to investors. Of course, it is to invest in a disciplined manner and allows an investor to invest a fixed amount of money at pre-defined intervals in the mutual scheme.

An investment and a fixed amount of money can be low as Rs.500 and includes SIP intervals on a weekly/monthly/quarterly, or annual basis.

Mutual Funds are allotted at the current Net Asset Value of the scheme.

By taking the SIP route to investments, the investors should be focused on time bound manner the market dynamics and stand the long term to average costing.

SIP Types

-

Flexible SIPs - The Flex SIP allows you to adjust based on the SIP amount with a financial condition. It is a pre-decided formula that belongs to market conditions and enables investors to invest more. It should be high enough to lower SIP.

-

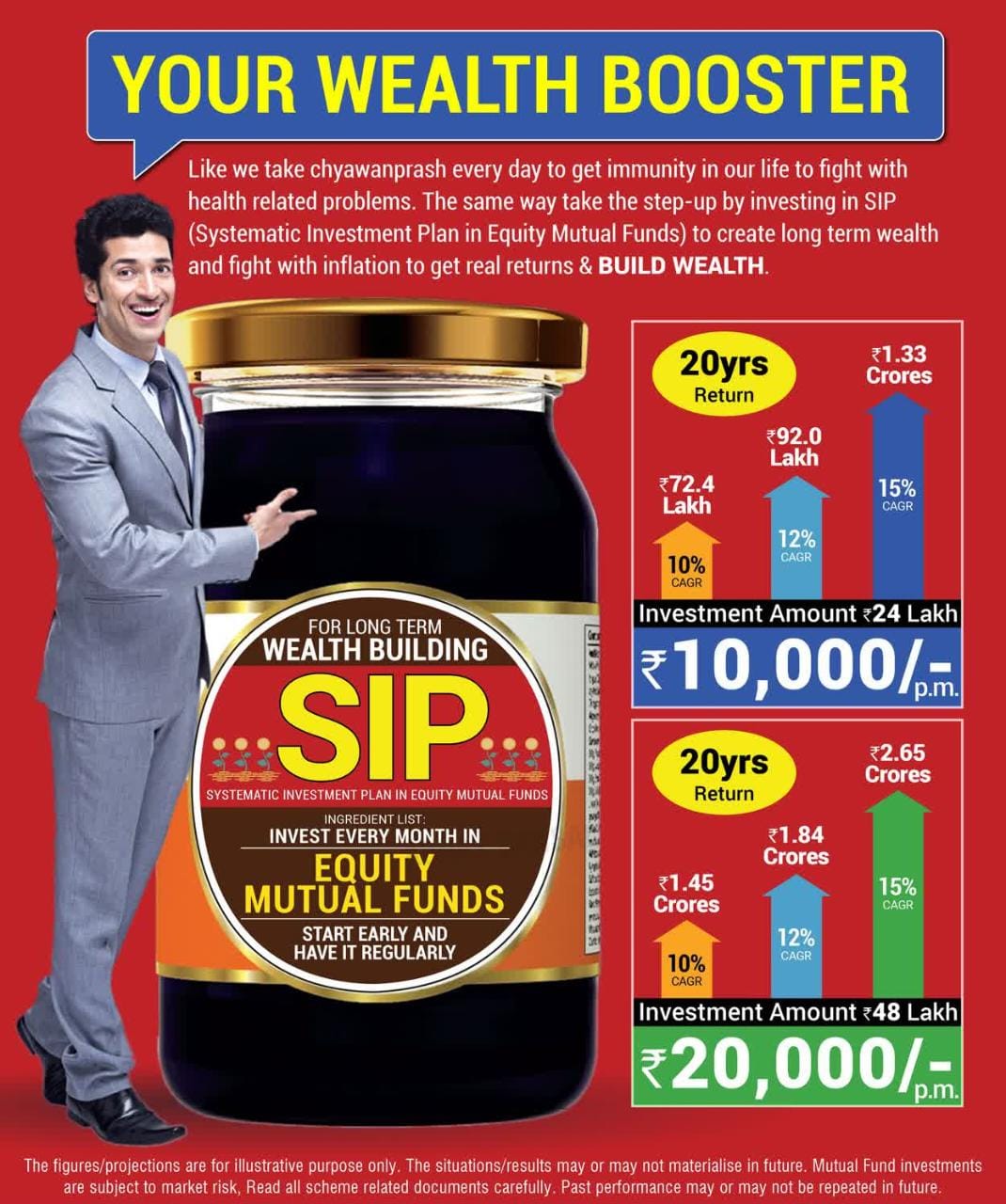

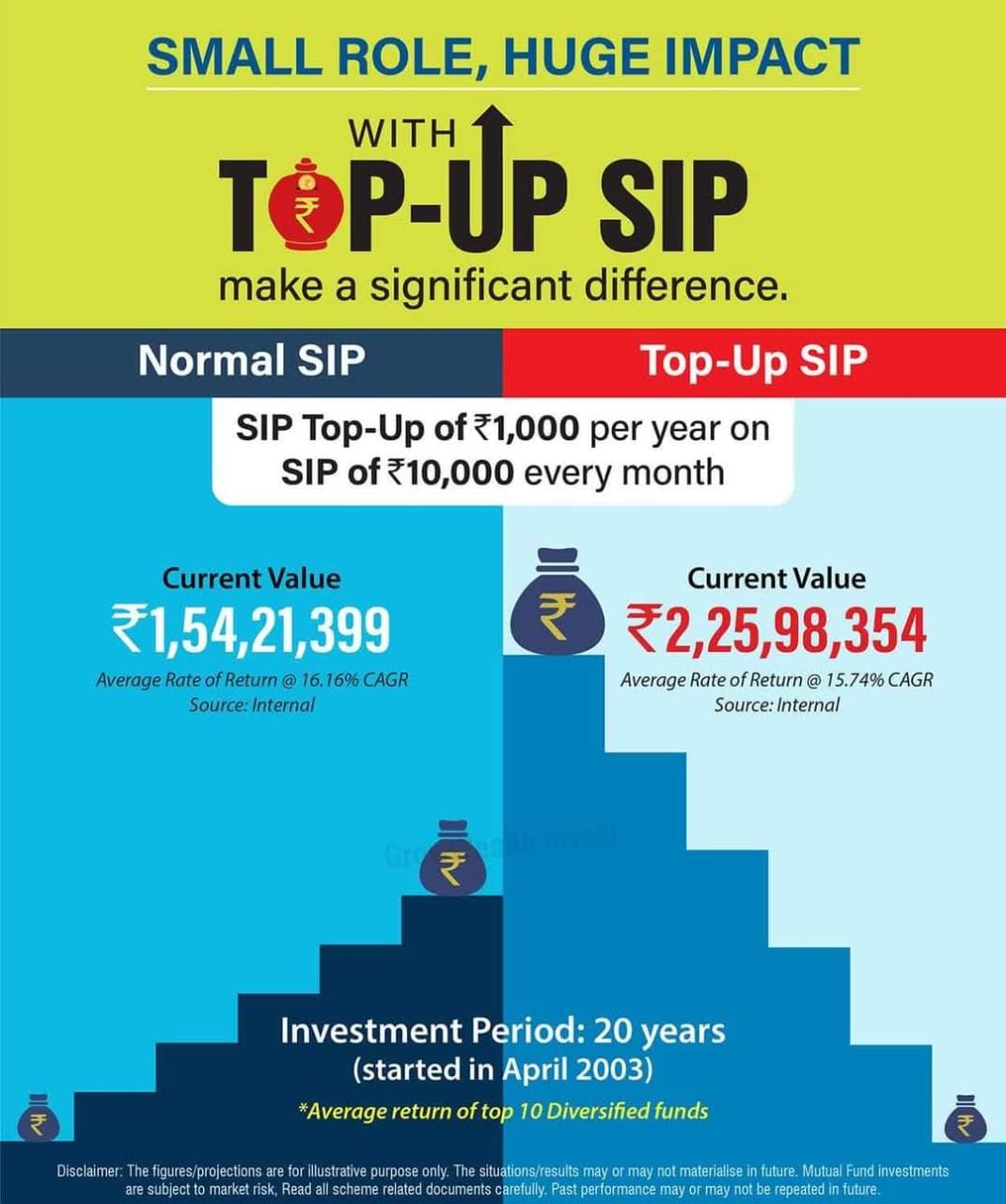

Step-Up SIP - Of course, Step UP SIP allows increasing the SIP amount at fixed intervals. They come with more options and start depending on the investment up to Rs.10000, which includes a fund scheme of your choice. It fully depends on the SIP amount to be taken every six months.

-

Perpetual SIP - Perpetual SIP has to take the best options available in the investment spectrum. It is linked to every SIP investor, starts a new SIP, and requires mentioning the start and end date. Investors should generally take with starting date, and most of it includes the ending date with a proper value.

-

Trigger SIP - With Trigger SIP, you must get a SIP investment based on the SIP amount to be withdrawn from your bank account and used for purchase units. In addition, it should be net asset value, and the scheme should be included on a certain level.

Benefits of SIP

There are several benefits of investing in SIP:

-

Power of Compounding - When you invest in the SIP, your investment should be updated on the compounding effect. It should be controlled with easy returns and mainly adaptive to the principal amount. It gains the principal amount and is taken back with time on the money your investment earns returns. The returns also earn returns based on the investment criteria.

-

Calculate the Monthly SIP Amount - You can even calculate the monthly SIP amount to achieve your goal on time. They should work based on the plan and need to associate with a tool for focusing on the monthly goal in time. You have to select the tenure and get a plan in place.

-

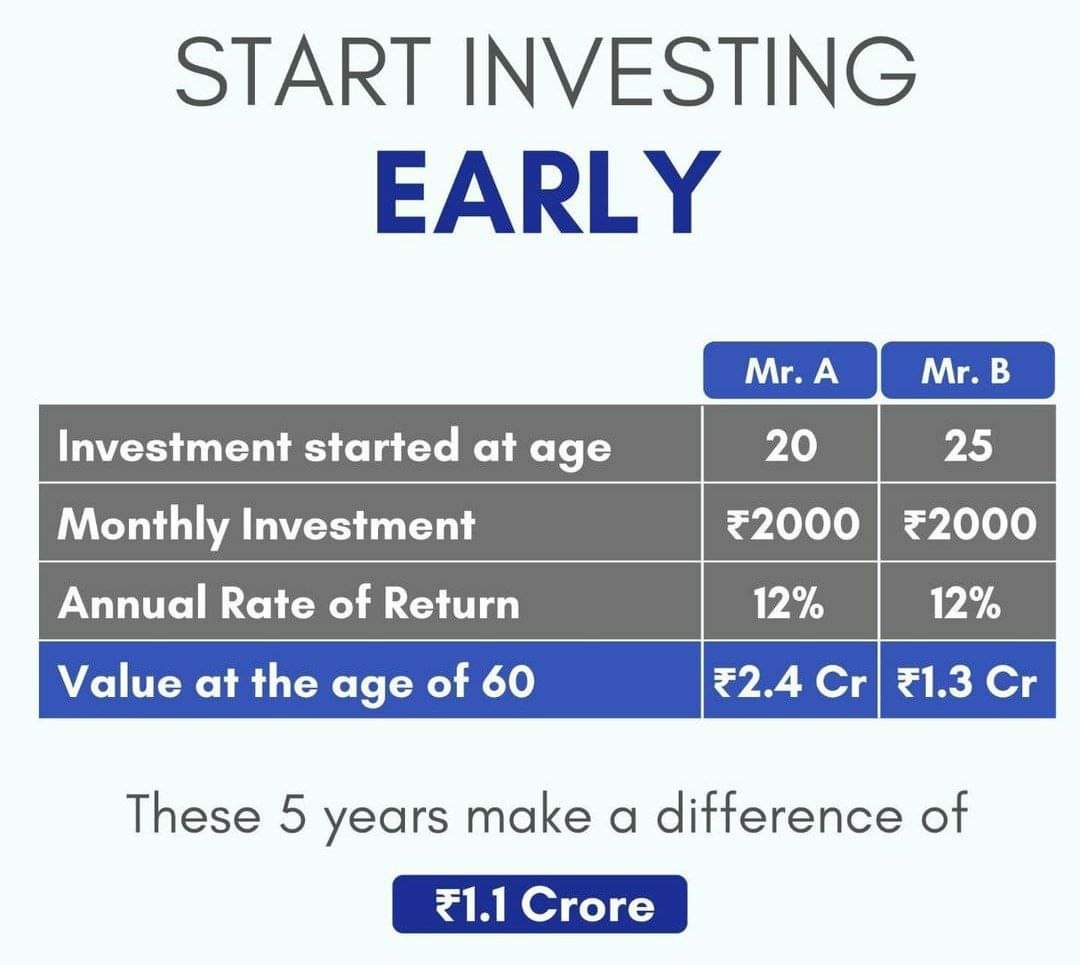

Power of Starting Early - The earlier you start to pay to save and invest regularly, the easier you can achieve your goals. The investment should be calculated monthly with the return at 12% pa.

-

Goal-based SIP Investing - The financial goals should be obtained well based on their plan and investment. It includes the essence of goal-based investing on the proper plan. They are important to notice each goal and are meant to update on specific amounts and financial goals.

Main Considerations :

At the same time, investors should know what does not include in SIP. When applying, you must notice some important considerations that are not valid for SIP investment and scheme. So, you must be aware of SIP, which does not include some factors for investment.

-

SIP investments don’t work in the bullish market

-

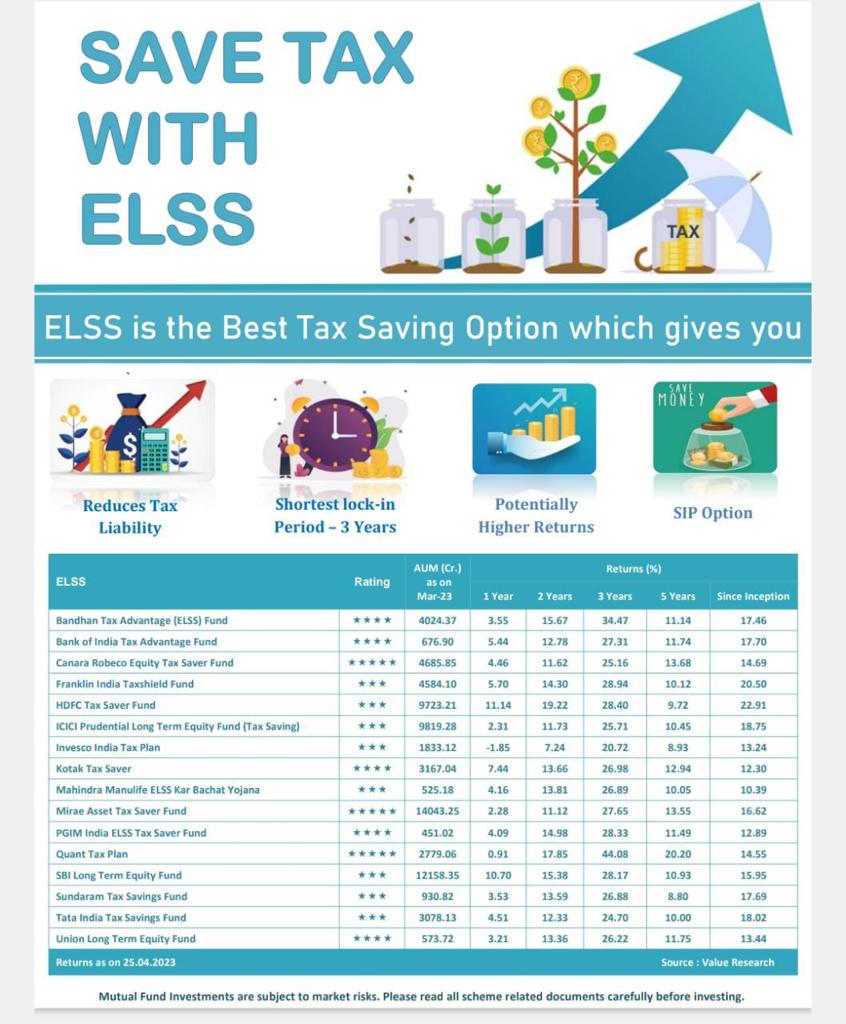

Tax saver, mutual funds scheme, locks your money for three years

-

Investments are locked individually from the date of applying

Documents Required

-

PAN Card

-

Address proof

-

Driving license/bank statement/utility bill

-

Passport size photograph

-

Cheque book

-

Aadhar number is not mandatory and simplifies the process

-

The procedure will be completed online and need a computer with an internet connection