Saving Plan

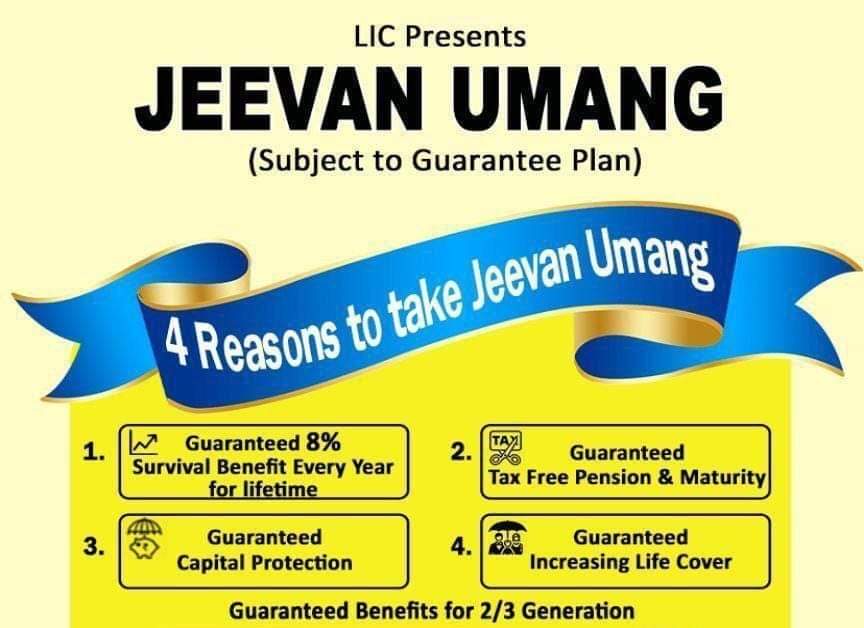

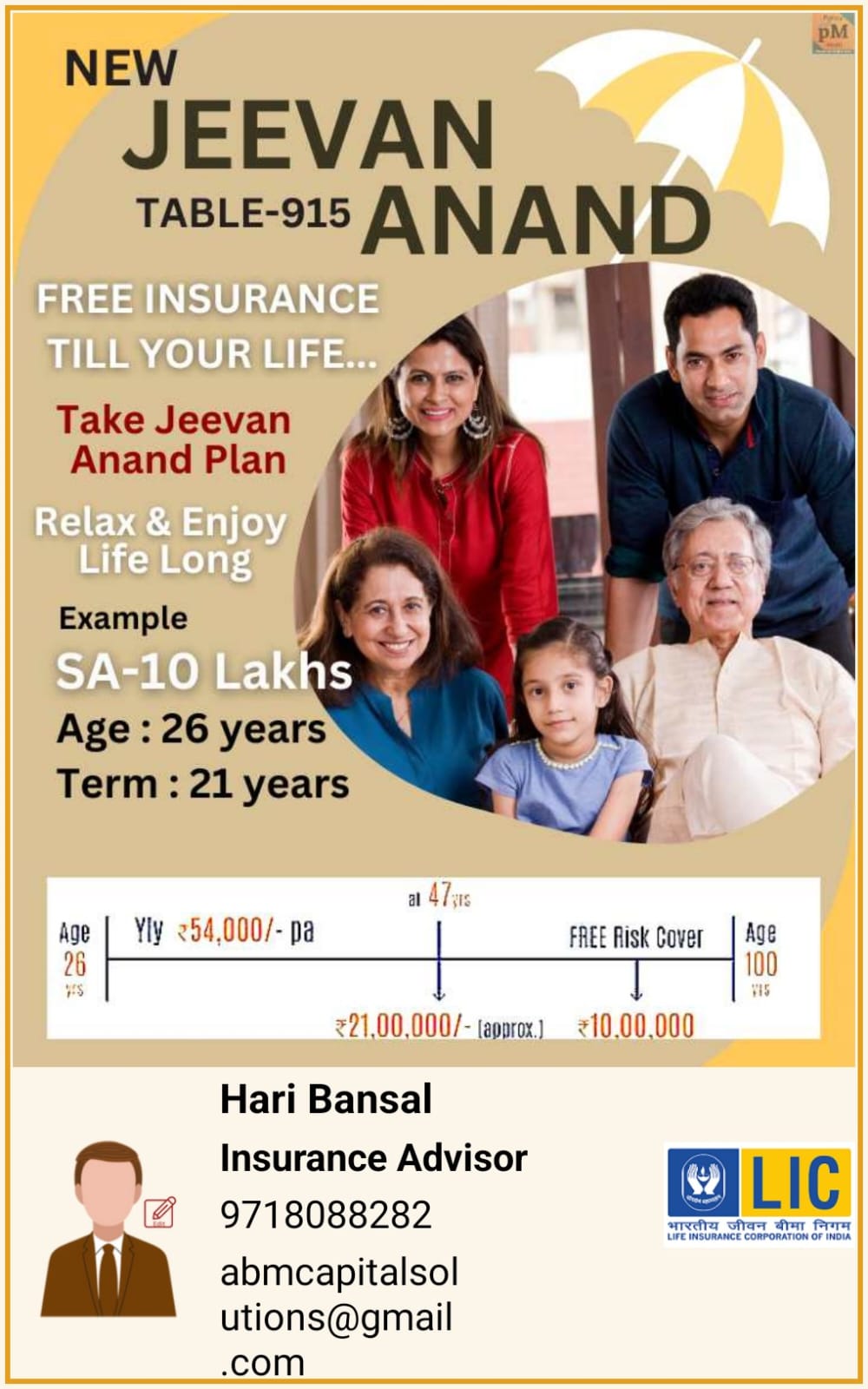

Life is all about happy and sad moments. Some of these moments would endow us with life lessons. These could also teach us to plan for a secure and bright future. Normally, it will be efficient to withstand robust financial planning during this situation. Having a good saving plan is most important for your financial portfolio. These could extensively combine the assured returns even after the specific time period. Savings plans are the instrument for providing a better opportunity to safeguard hard-earned money. These also combine with insurance as well as guaranteed benefits.

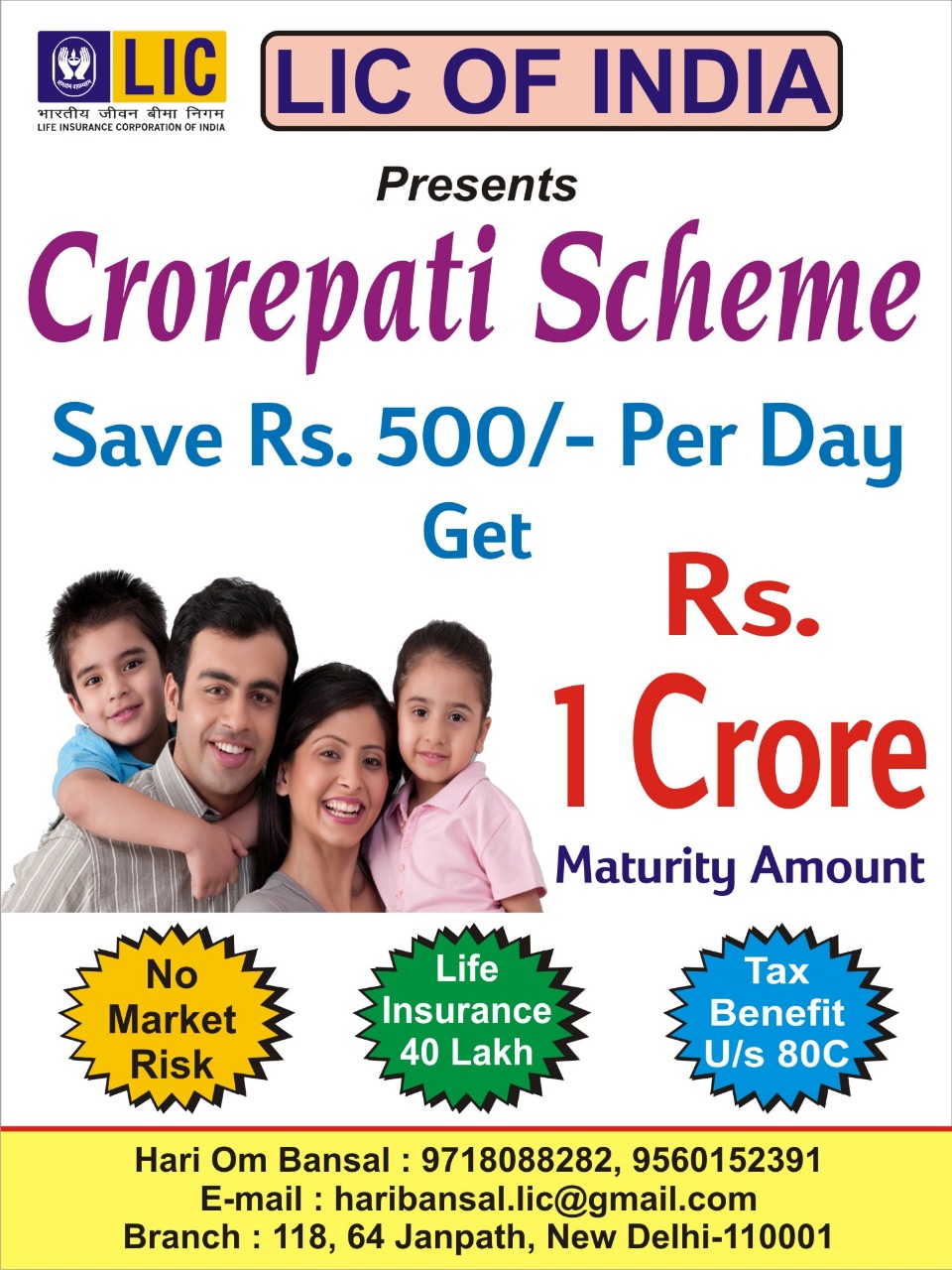

Savings plans are the best financial instrument for better wealth accumulation. So they provide you with more insurance coverage for the savings. Based on the saving scheme

- Death benefits are paid to the beneficiary of the policy if any unfortunate demise of insured

- Caters security and safety of interested capital

- Offers amazing features to meet individual's specific financial needs

- Low-risk financial instruments

- Low-risk financial instruments

Types Of Savings Plans:

- Money-Back Plans: – The financial instrument provides you the better periodic payouts during the specified intervals. It is a popular life insurance policy providing insurance as well as redemptions for the money. Money-Back Plans are suitable for individuals who require money at certain intervals.

- National Savings Certificate (NSC): – The NSC is a government-initiated savings scheme. It gives a better option for wealth accumulation with investments up to Rs.1.5 lakhs. These will be eligible for Tax Exemption U/S 80 C.

- Public Provident Fund (PPF): – National Saving Organization introduced the PPF or Public Provident Fund as a long-term saving scheme. These provide you with a term period of about 15 years. PPF is also the safest option for investment as it has an interest rate of 7.9%. Interest earned with this scheme is also Tax exempted.

- Senior Citizen Savings Scheme (SCSS): – Senior Citizen Savings Scheme has been introduced for senior citizens in the country. People above the age of 60 years can avail of this saving scheme. Individuals can gain greater benefits from financial security.

Benefits

A savings plan is one of the best options for gaining massive benefits for your life and family. Below are some of the benefits listed.

- Offers a life insurance component

- Meeting Financial Goals

- Helps to build a financial habit

- A considerable assortment of savings with the investment plans

- Security for your family against financial crisis

- Coverage with multiple riders

- The convenience of the policy term

- Tax benefits

- Maturity Benefits

Documents Required:

Prospective policyholders will need to comply with Know Your Customer (KYC) guidelines before availing of the saving scheme. Below are some of the documents required for buying the saving policy.

- Permanent Account Number (PAN) or Form No. 60

- Driving License

- Passport

- Photograph

- Voter's Identity Card issued by the Election Commission of India

- Job card issued by NREGA duly signed

- Proof of possession of Aadhaar Number

What Is Not Included?

The insured needs to check what the policy does not cover before buying them. Below are some of the typical claims excluded by insurance companies.

- All policies contain a clause if there is a death related to the policyholder's participation in any criminal activities.

- Policies do not cover loss of life due to HIV and STDs

- Insurance denies claim whether any human-made disaster or damage caused by negligence on human beings

- Policy ends after a set number of years in the policy's term

- If the policyholder dies from any water-sports activities, paragliding, rock-climbing, or others, the beneficiary will not receive a death benefit

- All policies do not cover claims if the policyholder is involved with deliberate self-harm or self-inflicted surgery