Retirement & Pension Plan

Retirement and pension plans are highly beneficial for working individuals to support their retirement income needs. Pension is a basic part of the financial planning of every individual. It helps individuals access sufficient funds to support their expenses after stopping working.

It is a defined contribution plan where employees and employers make contributions. This plan has no assurance for a fixed pension, and the contributions are tax deferred until the withdrawals are made.

The pension plan is the defined benefit policy where the employer contributes a guaranteed sum to an employee’s retirement based on their compensation history, such as age and years of experience. Employees will receive a huge sum at once or a monthly payment at retirement. The funds added to the pension plan grow over time as the investment grows.

These investment savings provide a huge sum of money for the policyholder upon their retirement. Pension plans assist every individual in dealing with their post-retirement easily and enjoy a steady flow of income after retirement.

Retirement & Pension Plan Types

-

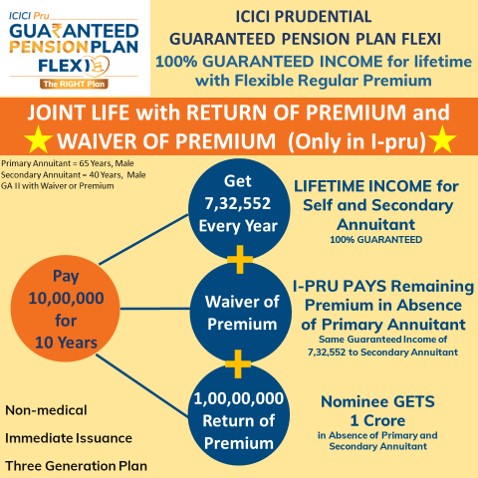

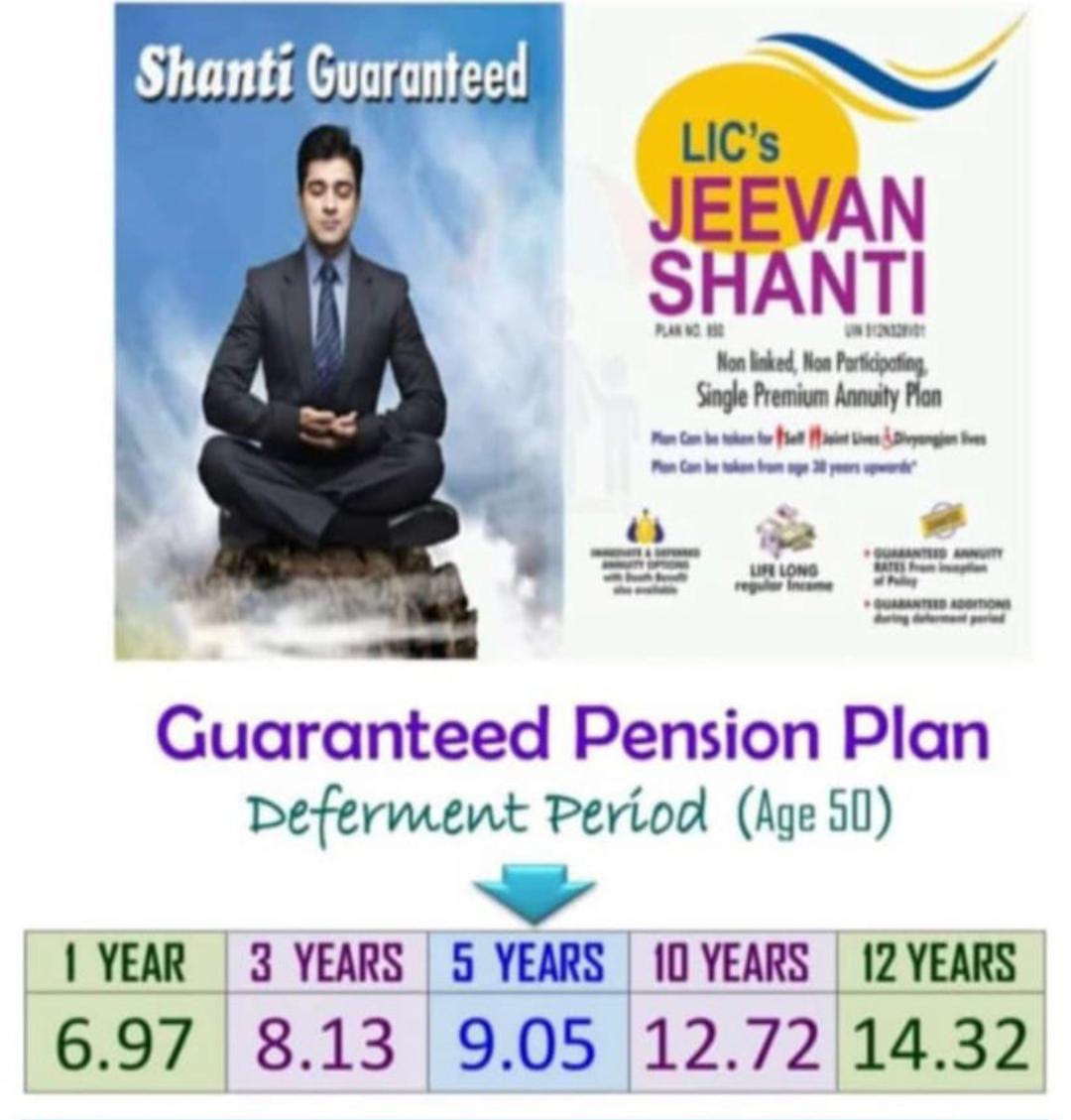

Annuities – These financial products give a proper flow of income after retirement and are purchased from the insurance company. These may be different types like fixed annuities, variable annuities, and indexed annuities.

-

National Pension Scheme – This scheme was launched by the Government of India in 2004 and is open to every citizen between 18 years to 65 years of age. Individual makes regular contributions to their retirement account and these contributions are invested in various securities to earn long-term returns.

-

Defined benefit – In this, the employer guarantees a certain retirement benefit to the employee.

-

Define contribution – In this employer and employee, both contribute a fixed amount of money which is then invested in some investment options. The benefit depends upon the market performance of that investment.

-

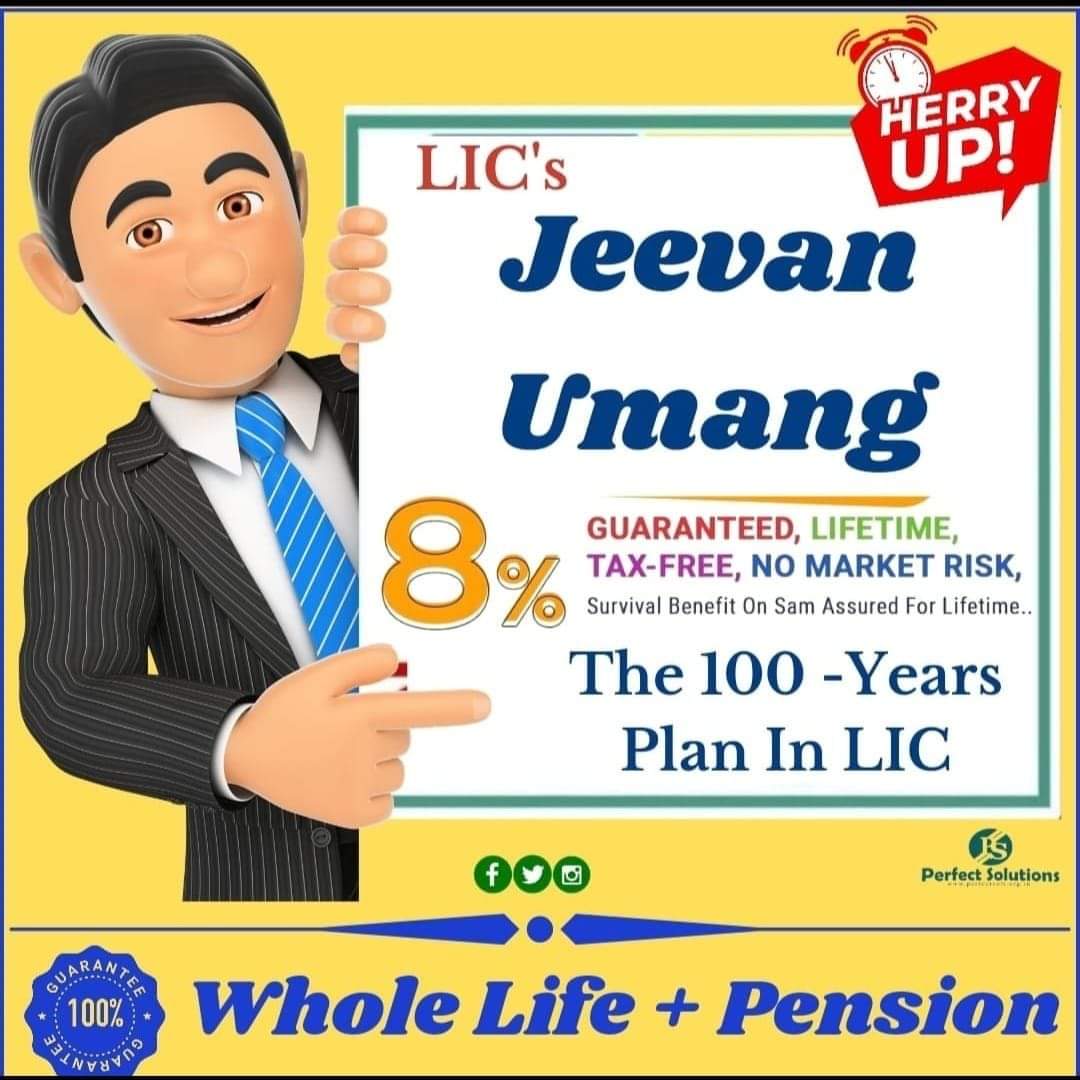

Whole-life ULIPs – These have a fixed term of coverage, whole life ULIPs offer coverage for as long as the policyholder lives, as long as the premiums are paid.

Benefits of Retirement & Pension Plan

Unlike before, individuals now understand the importance of retirement and pension plans. It makes us provide the best pension plans. Investing in our pension plans will provide the following benefits for the policyholders.

-

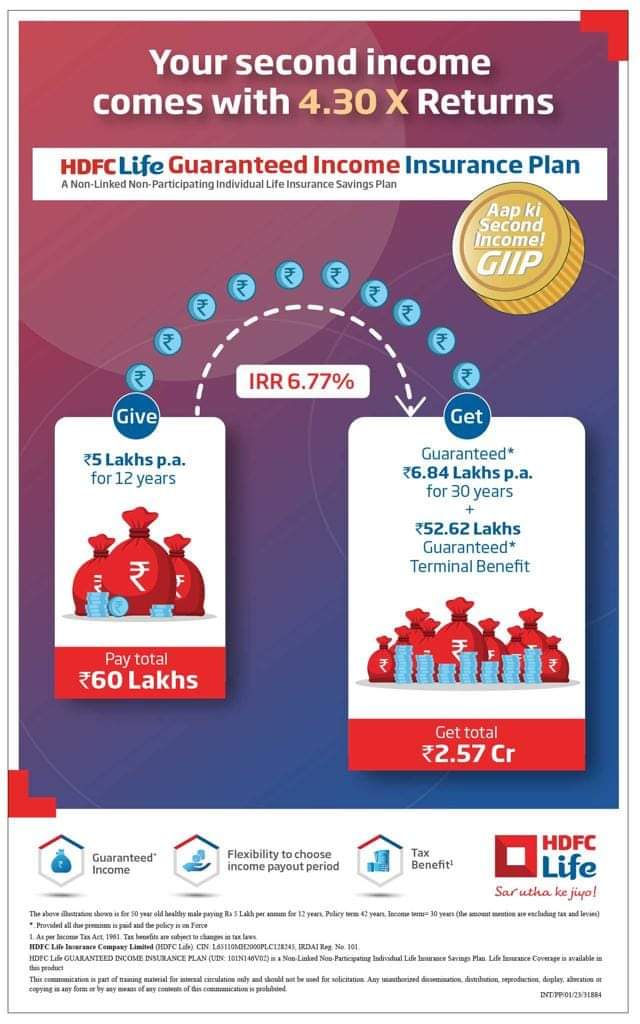

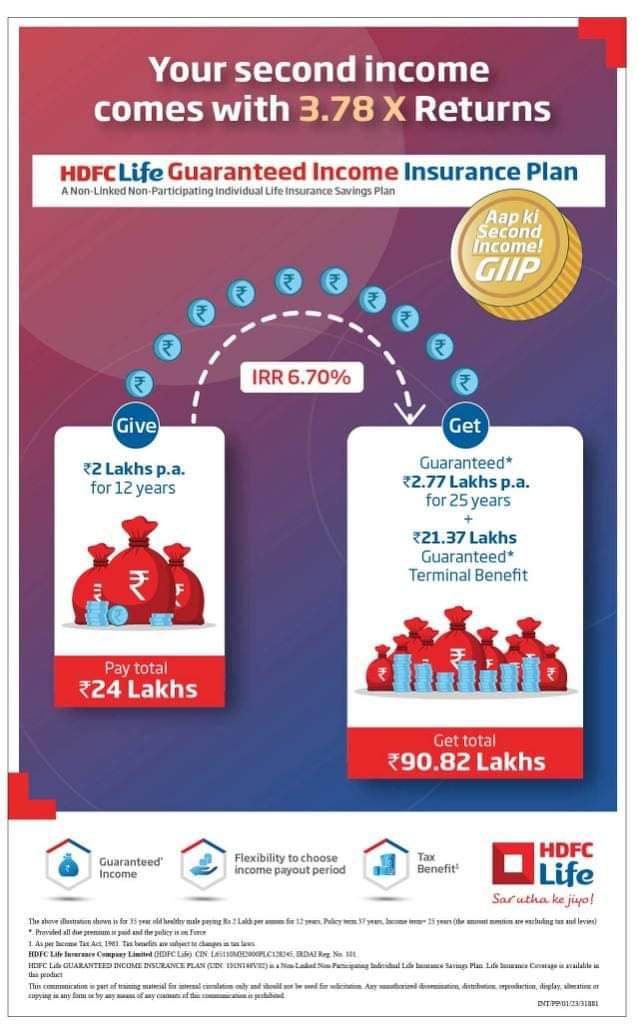

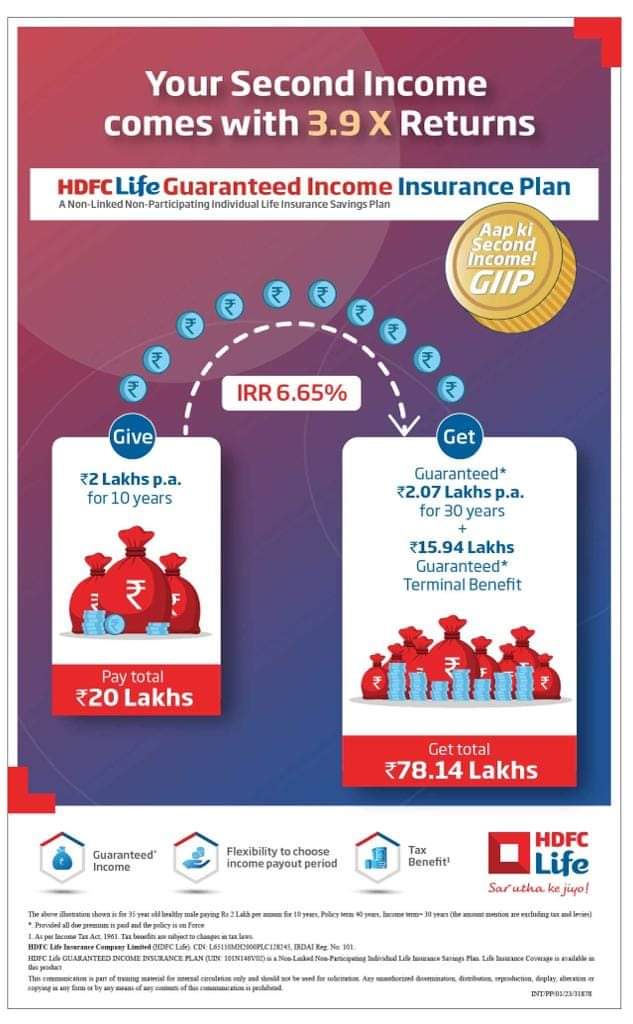

Fixed Income during retirement period : With retirement and pension plans, individuals will obtain a guaranteed or fixed income to support their retirement planning. It also renders an option to offer income to the policyholder’s spouse in case of their death.

-

Death Benefits : Pension plans usually render the death benefit to help the insured family in case of their absence. So, the nominee will obtain the sum assured or death benefit after the policyholder’s death.

-

Customize Plans : Insurance agents provide customization options to get retirement and pension plans suitable for individuals’ needs and financial stability. Customizing the retirement plan will help them and their family avail extra protection

-

Flexible : Enjoy the flexibility to select the premium payment term with the retirement and pension plans. It means you can easily choose the premium payment term suitable for your financial goal.

-

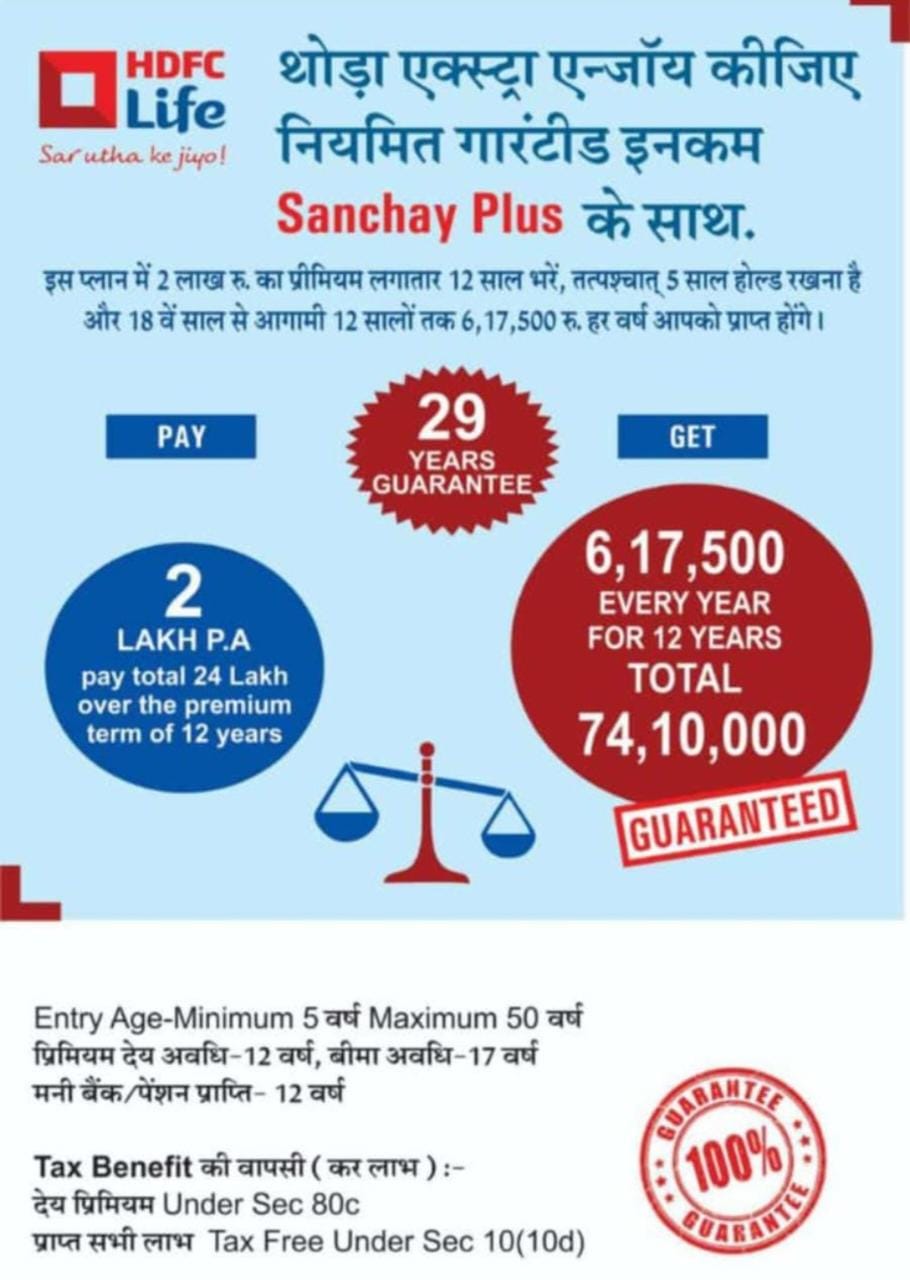

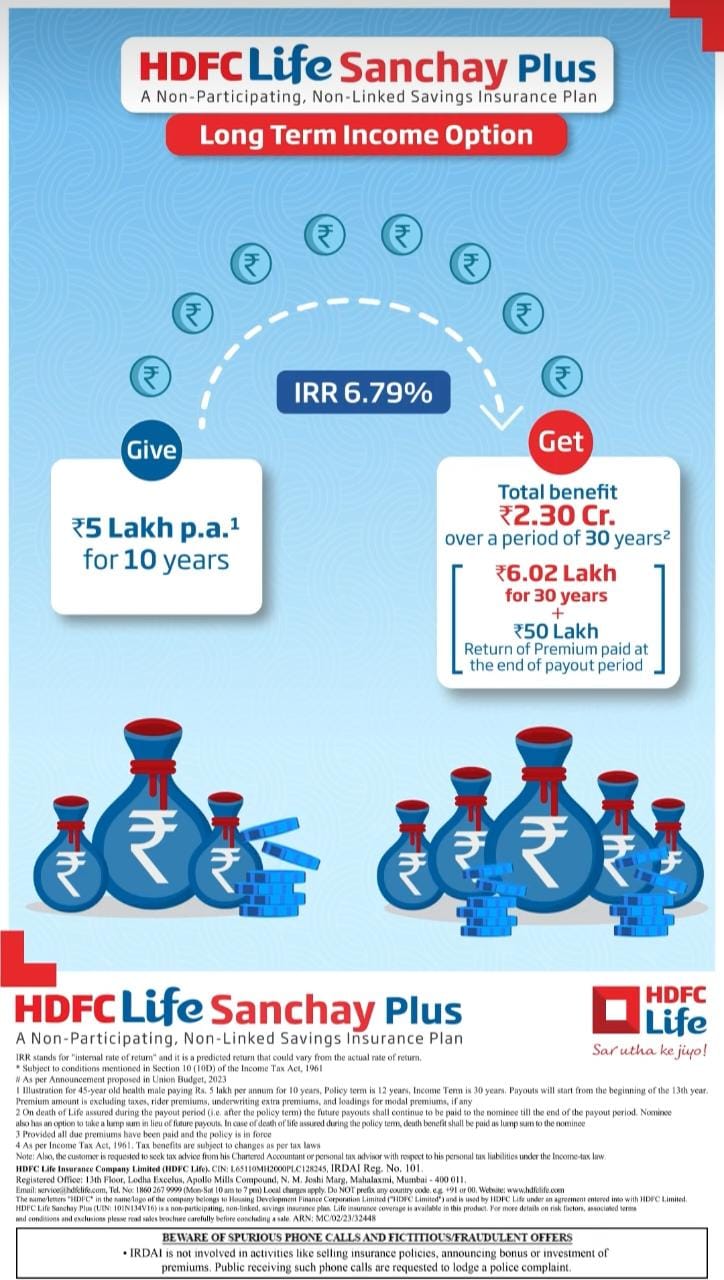

Tax Benefits : Pension plans qualify for the tax deduction, but check your policy details beforehand. It helps your investment in retirement planning save more on tax. Proper planning will help you enjoy tax benefits greatly.

-

Protection from Investment Risks: The retirement and pension schemes protect the policyholder against investment risk. So, you do not have to worry about investing money in pension plans and enjoy huge payouts in the future.

-

Guaranteed Income : A pension scheme renders a guaranteed income to help policyholders effectively fulfill their day-to-day expenses. It helps them lead a happy life after retirement and enjoys every moment with their loved ones.

Documents Required

-

Identification proof – Passport/ Driving License/Any Other Government-issued document.

-

Age Proof – Birth Certificate/Passport/ Any Other Government-issued document.

-

Address Proof – Utility Bills/Rent Agreement/Any Other Government-issued document.

-

Proof of Income (pay slips)

-

Beneficiary Details