Lumpsum Mutual Funds

In general, the lumpsum mutual funds mainly refer to the investment of the bulk amount at mutual funds very effectively. If you prefer this kind of investment, then certain sum will be tied with the one-time mutual fund investment which is said to be the lumpsum investment in mutual fund.

The lumpsum investment is the most effective ways of investing in the mutual fund. The lumpsum investment is perfectly suitable for investors with the considerable disposable sum in the hand. The lumpsum mutual funds can be the best choice for those who want to invest a lot and get a huge return as profit.

You can also make use of the major part of your savings via investing it in the mutual funds through the lumpsum method.

Lumpsum Mutual Fund Types

-

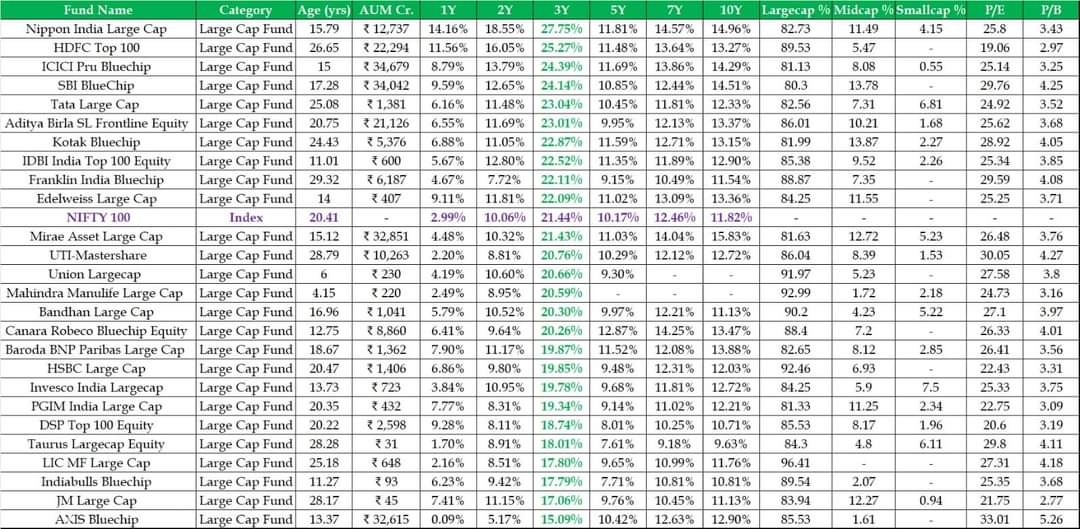

Equity Mutual Funds

-

Baroda BNP Paribas Large Cap Fund Direct-Growth

-

Canara Robeco BlueChip Equity Fund Direct-Growth

-

UTI Nifty200 Momentum 30 Index Fund Direct-Growth

-

-

Debt Mutual Funds

-

HDFC Credit Risk Debt Fund Direct-Growth

-

Nippon India Credit Risk Fund Direct-Growth

-

ICICI Prudential Regular Savings Fund Direct-Growth

-

-

Hybrid Mutual Funds

-

ICICI Prudential Equity & Debt Fund Growth

-

Aditya Birla Sun Life Equity Hybrid 95’ Fund Growth

-

Quant Absolute Fund Direct-Growth

-

Benefits of Investing in Lumpsum Mutual Fund

There are wide ranges of benefits you can get through lumpsum mutual funds. Those benefits are:

-

Convenience - The lumpsum investment is contrary to SIPs which does not need the investors to periodically invest at the fixed time interval. A lumpsum, one-time payment can be the easy and hassle free method to invest in the mutual funds.

-

Free of investment commitment - The lumpsum mutual funds never compel the investors to make some investment for the future. Therefore it is the highly preferable investment method for those who lacking the fixed income.

-

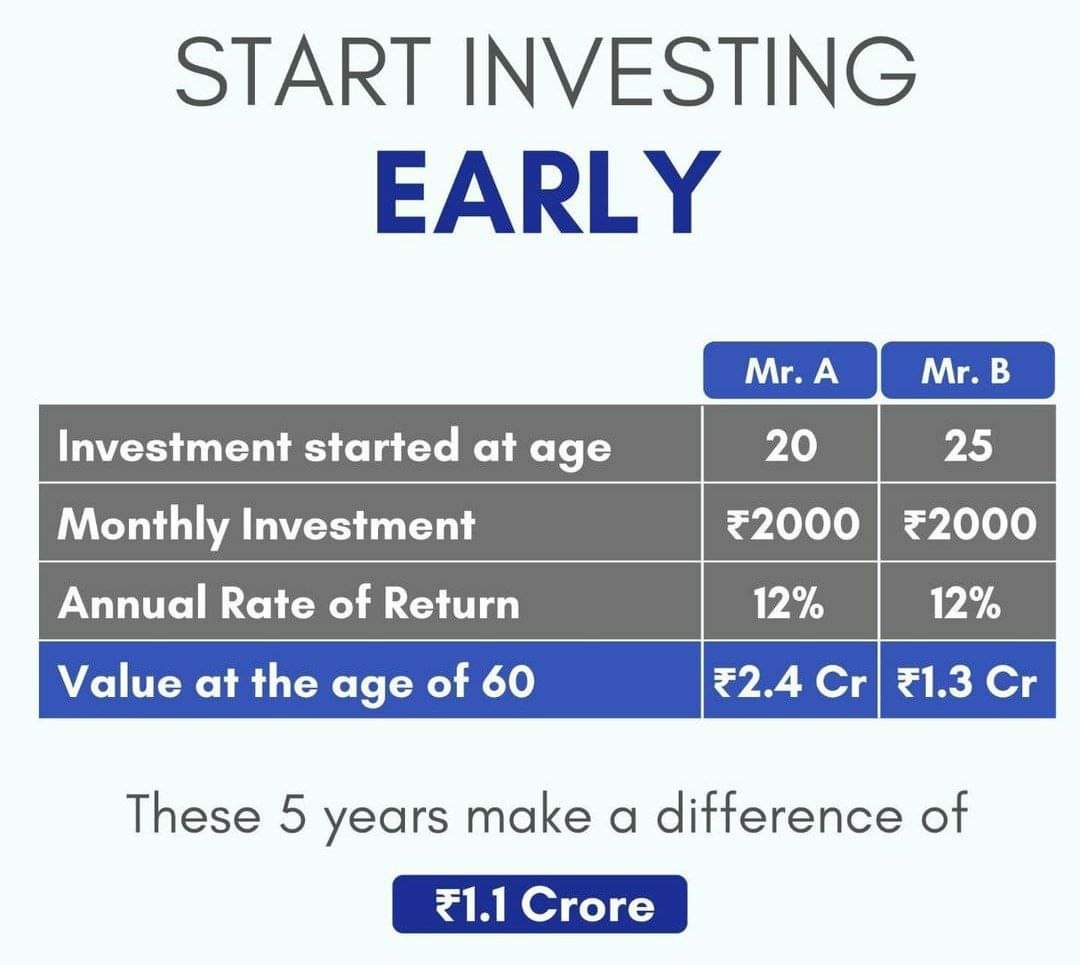

Benefit of compounding - The compounding mainly refers to the effective process where the existing return earned on the investment can generate more returns for investors. The lump sum investment let the investors to completely enjoy the overall benefits of compounding.

The lumpsum investment benefits are realized particular at the time of the bearish market conditions. It can occur as the investor can buy more mutual funds at the reduced rate and decides to sell when the market conditions enhance. Therefore, you can secure the optimal profit very effectively.

Main Considerations :

-

Expense Ratio

-

Investment Objective

-

Past Performance of Funds

-

Risk-Return Analysis

-

Experience of Fund Manager

Documents Required

-

PAN with photograph

-

Passport

-

Aadhaar

-

Driving licence

-

Voter's ID card

-

Registered lease or sale agreement of residence

-

Ration card

-

Insurance copy

-

Flat maintenance bill

-

Utility bills like landline telephone bill, gas bill or electricity bill

-

Memorandum & Article of Association

-

Certificate of incorporation or registration

-

Authorised person’s signature

-

Address proofs

-

Bank Statement

-

Deed of declaration of HUF

-

Power of Attorney

-

Trust deeds

-

Self-certification on letterhead

-

Certificate of registration with SEBI