Investment Plans

In general, the investment plan is an effective plan to meet the investing goals. It can inform people’s decisions and enhance their chances of getting satisfactory returns.

We at ABM Capital Solutions collaborate with top investors to carry out and develop well-structured plans. Hence you can get help from us to invest with more confidence. Therefore contact us today to discuss your financial goals and needs.

Are you looking for the best investment plan? Then you can consider Unit Linked Insurance Plan (ULIP) and Endowment Plan. Both these investment plans can offer you a wide range of benefits.

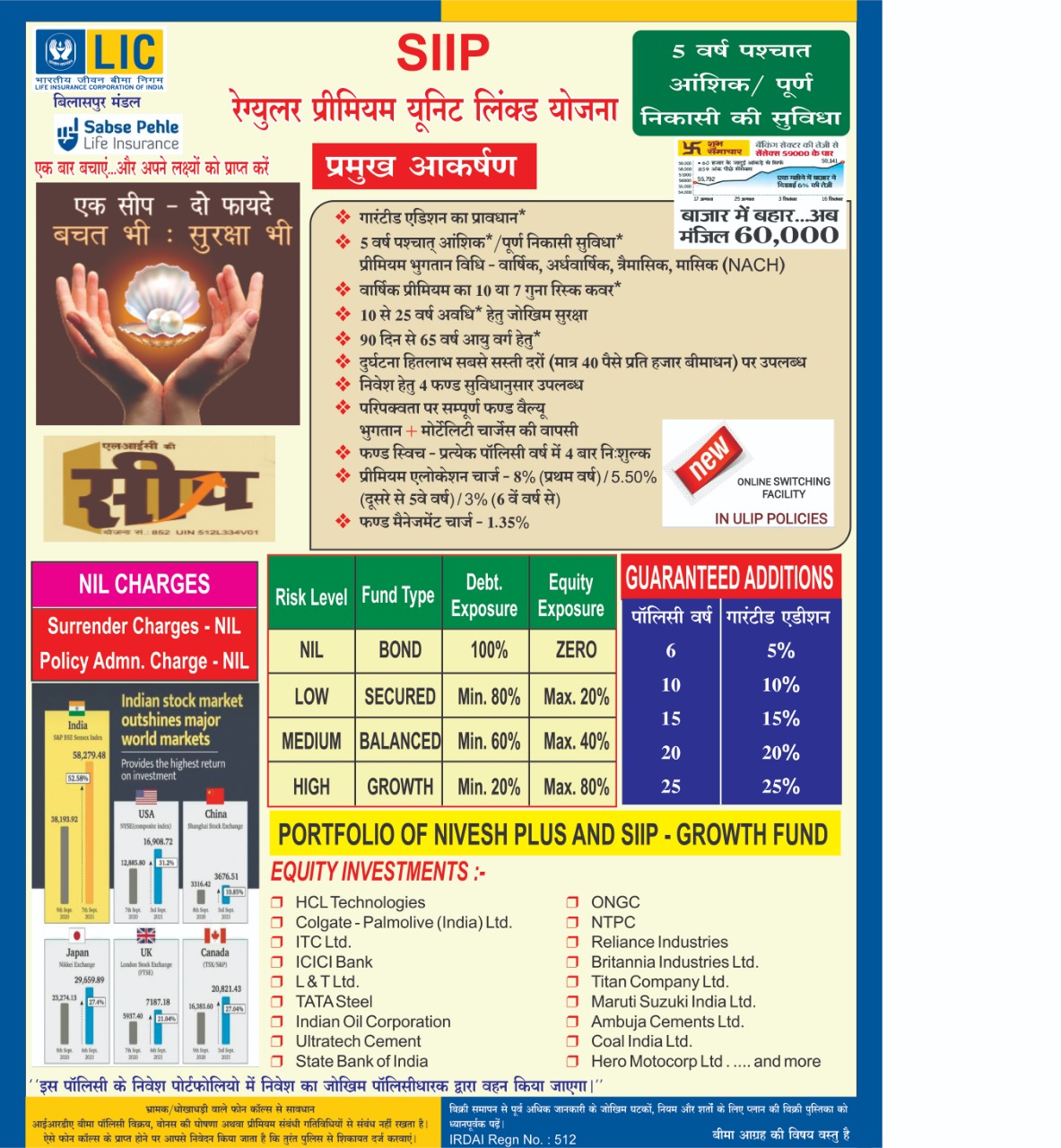

Unit Linked Insurance Plan

Unit Linked Insurance Plan provides insurance and a means for investment under a single plan.Types

Classification by Purpose

- For Children's Education - For those who want to build their child's career, sure Unit Linked Insurance Plan is a perfect choice.

- For Health Benefits - If you want more health benefits in the future, then you can go with the Unit Linked Insurance Plan.

Classification by Death Benefit

- Type I Plan - Here the nominee can get more fund value or sum assured as the death benefit..

- Type II Plan - Here the nominee gets both the fund value and sums assured during the policyholder's demise.

Benefits

A savings plan is one of the best options for gaining massive benefits for your life and family. Below are some of the benefits listed.

- Best for Long–Term Goals - If you want to meet your long-term goals, such as buying a new house or car, then Unit Linked Insurance Plan is the best.

- Provides Flexibility - You can change funds according to your requirements since it is flexible.

- Financial Security after Retirement - You can build the corpus for retirement through the Unit Linked Insurance Plan.

- Create Corpus for Family's Purposes - Unit Linked Insurance Plan can help you save money for your family's betterment and the marriage of the child's future

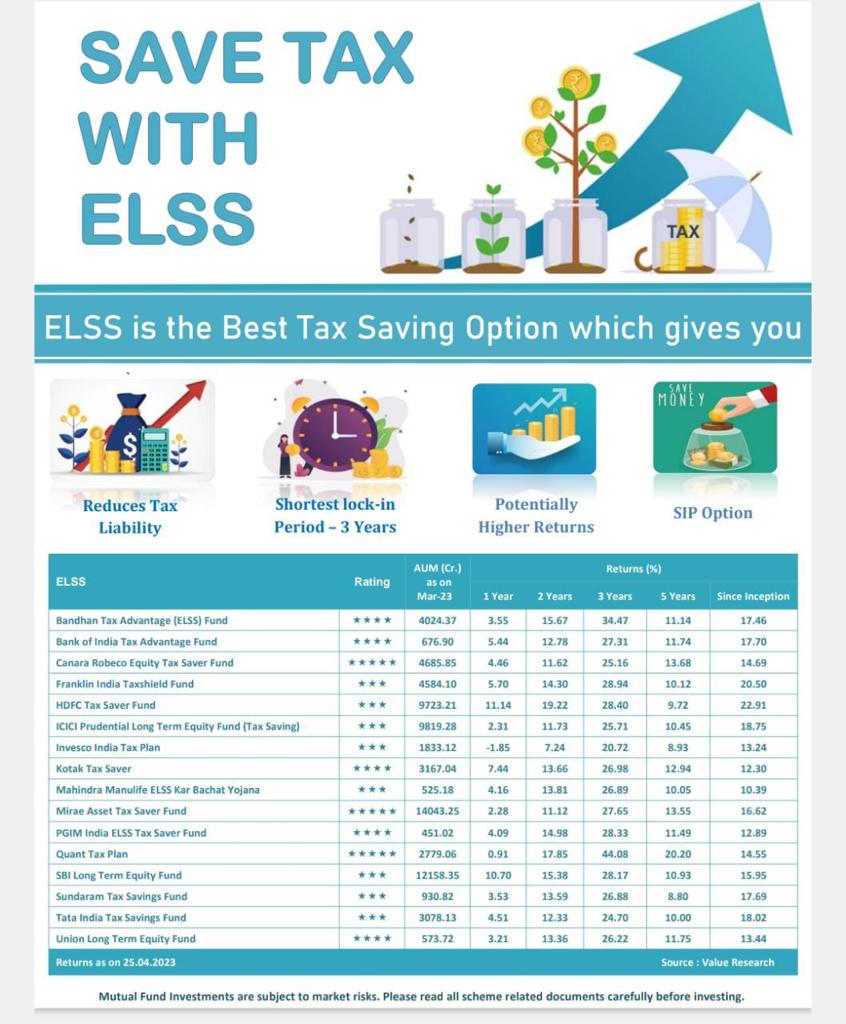

- Income Tax Benefits - You can grab more income tax benefits through Unit Linked Insurance Plan.

Documents Required:

Prospective policyholders will need to comply with Know Your Customer (KYC) guidelines before availing of the saving scheme. Below are some of the documents required for buying the saving policy.

- Permanent Account Number (PAN) or Form No. 60

- Driving License

- Passport

- Photograph

- Voter's Identity Card issued by the Election Commission of India

- Income tax return / Bank Statement

- Proof of possession of Aadhaar Number

What Is Not Included?

The insured needs to check what the policy does not cover before buying them. Below are some of the typical claims excluded by insurance companies.

- Death by accident due to alcohol usage.

- Death due to drugs usage.

- Death due to committing suicide.

- Death due to dangerous sports like racing.

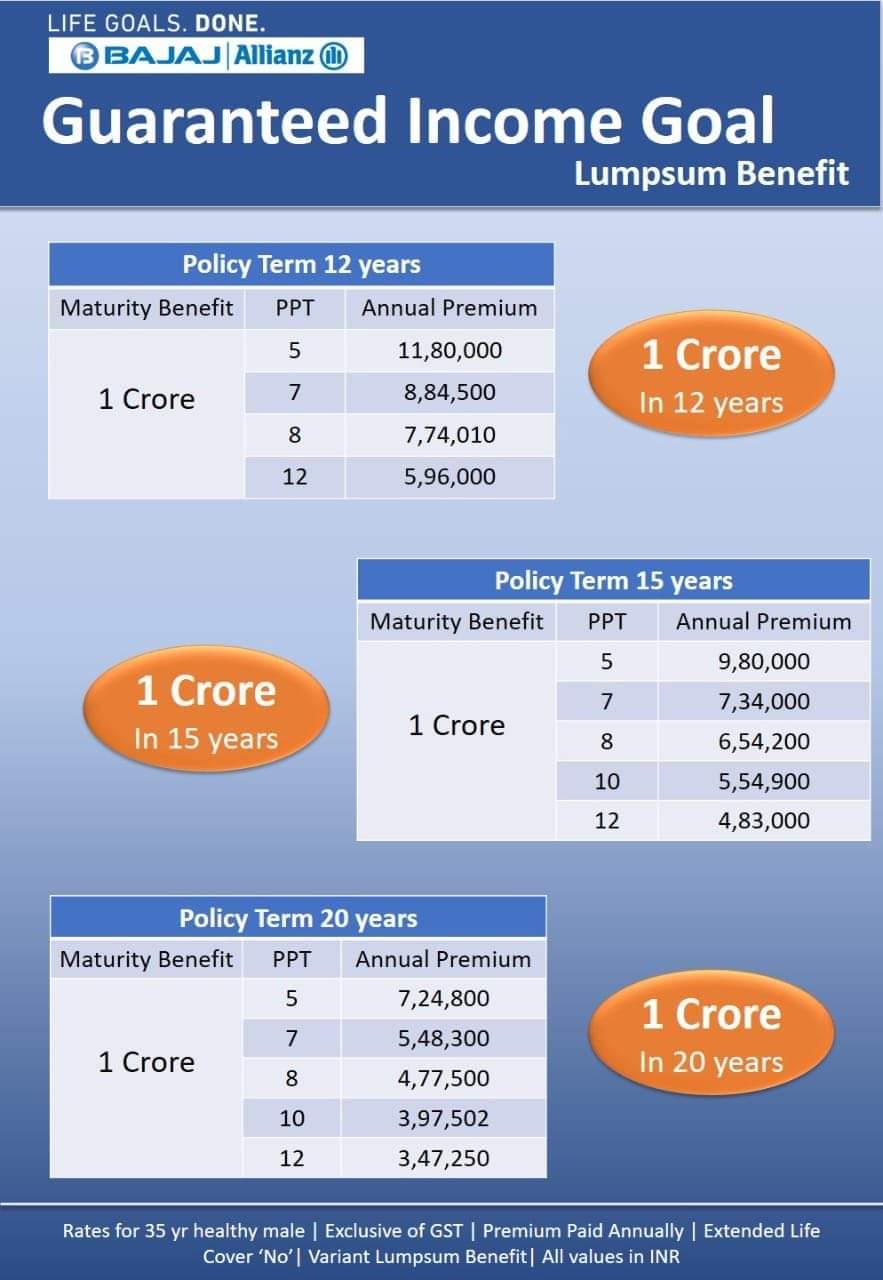

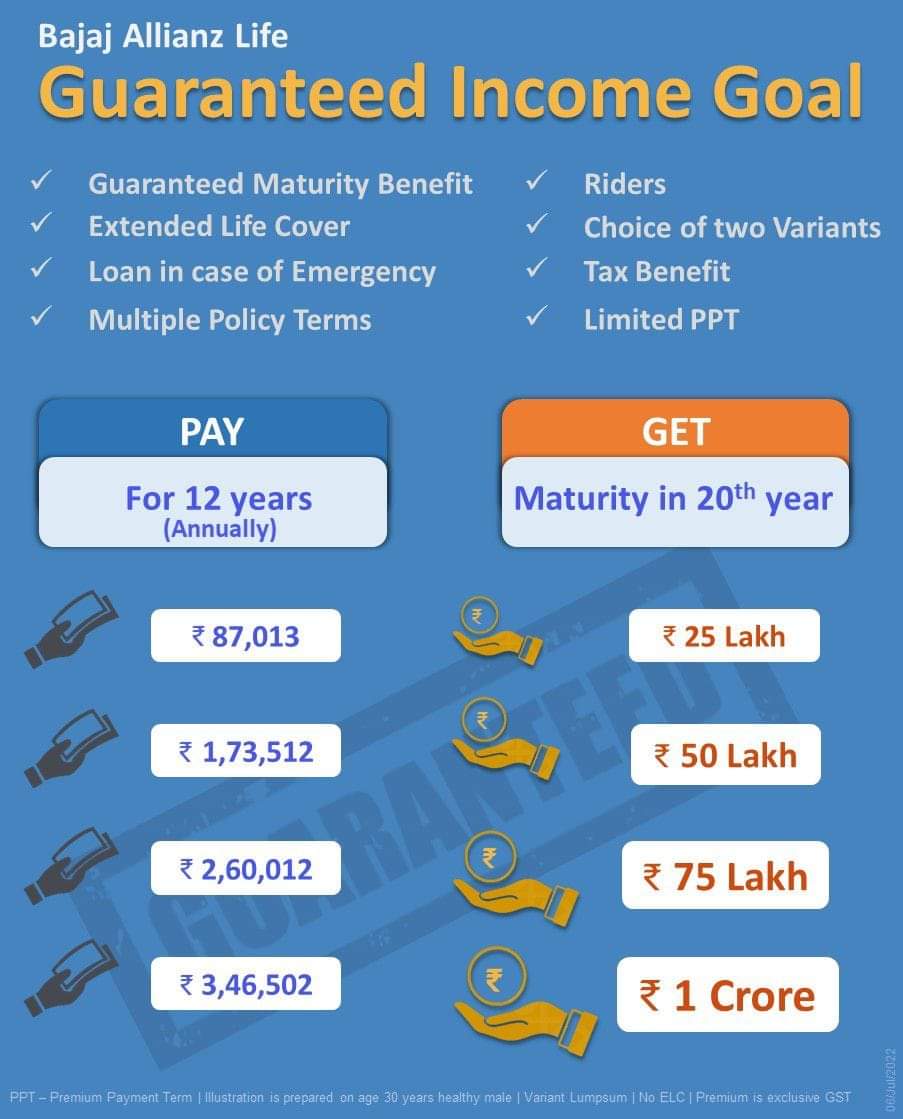

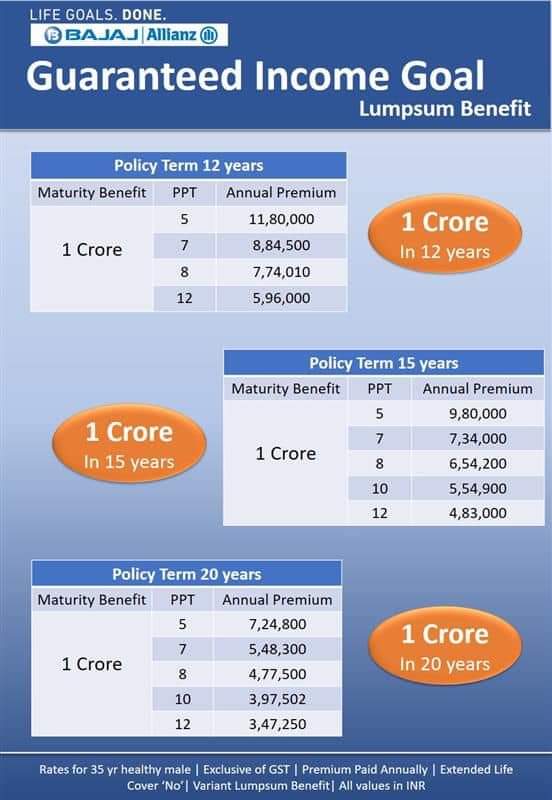

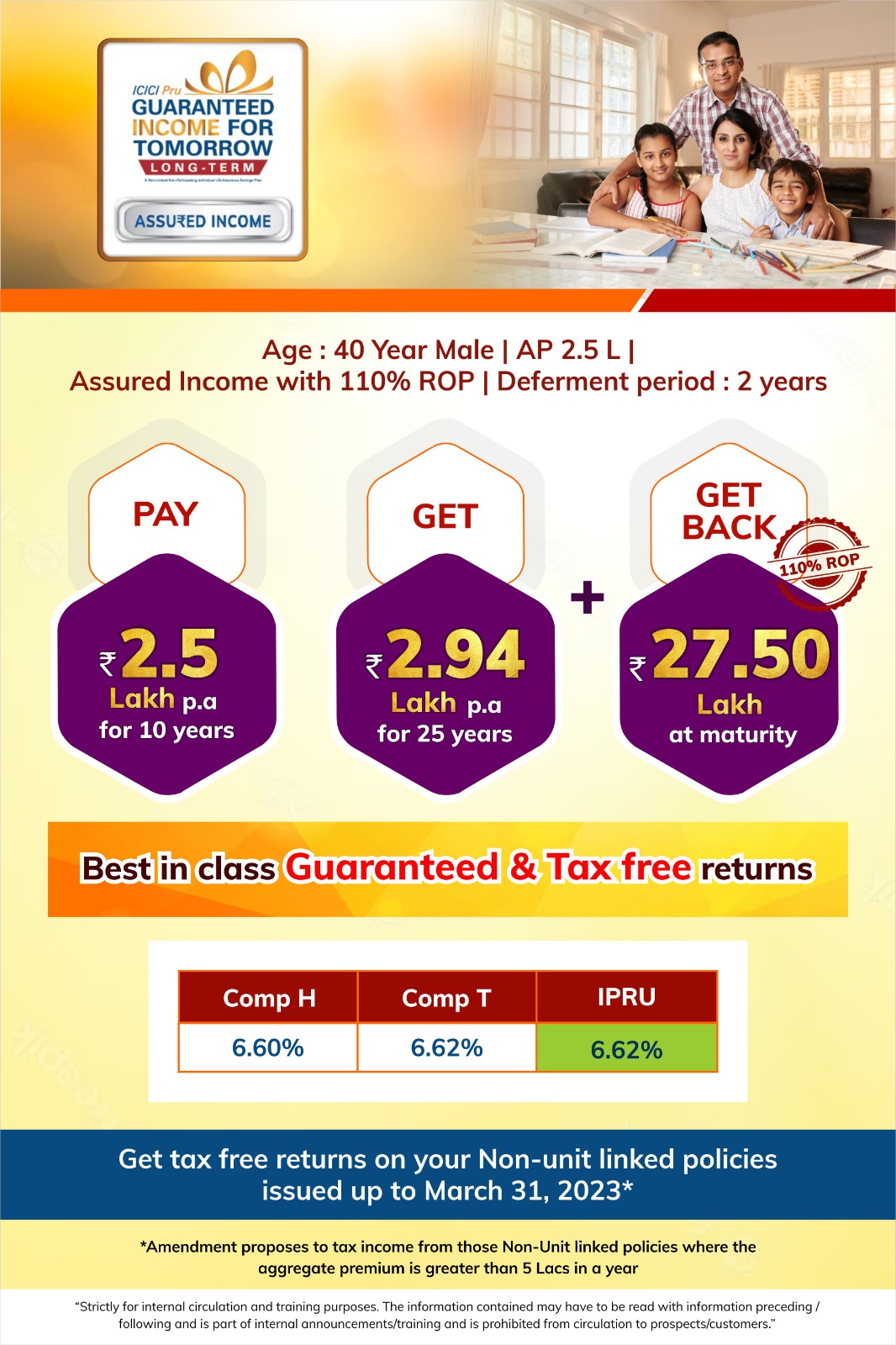

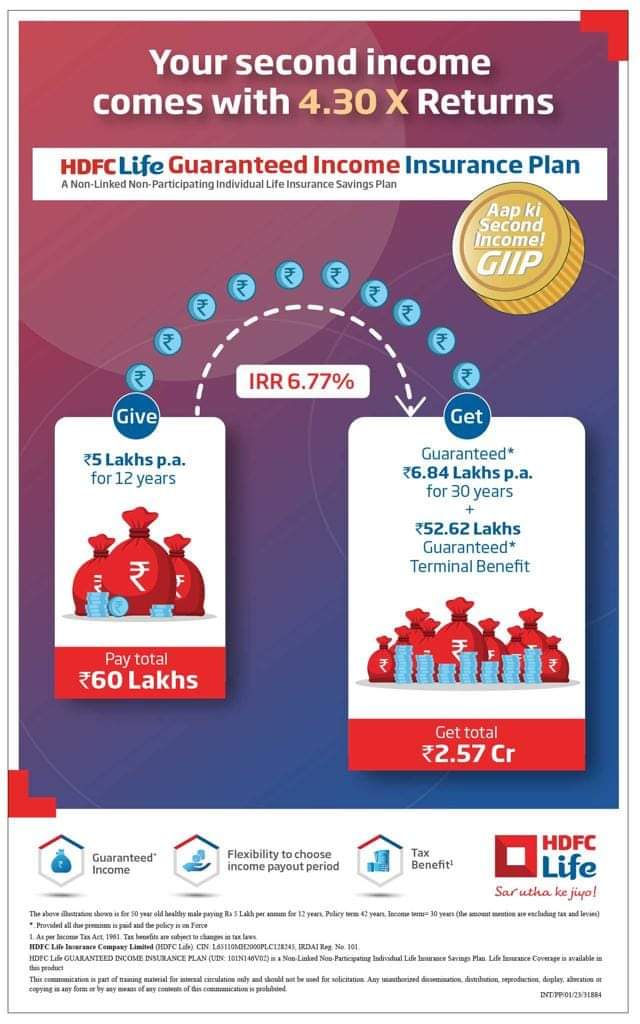

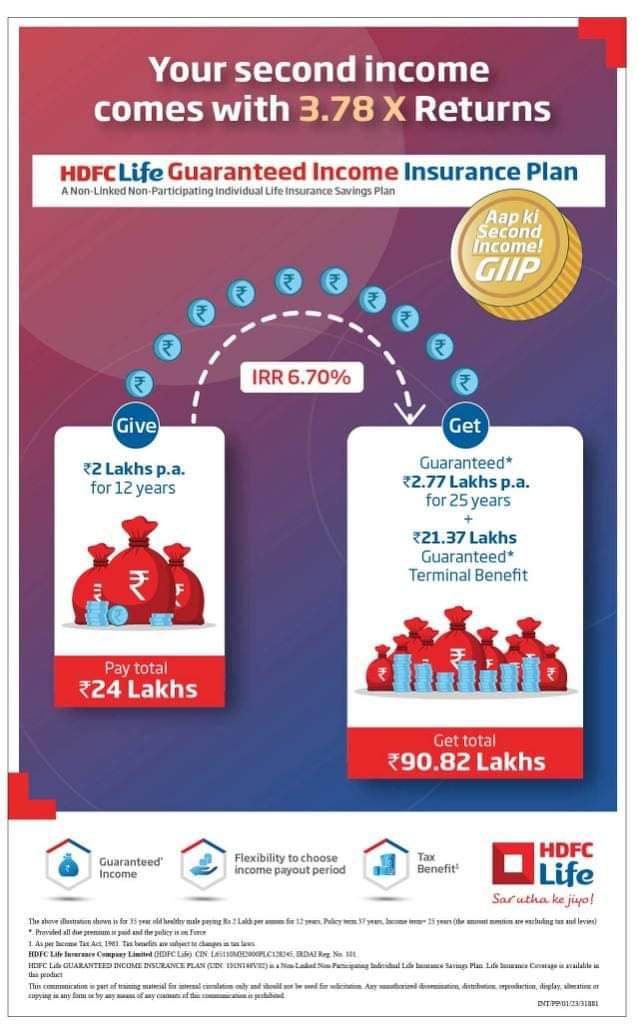

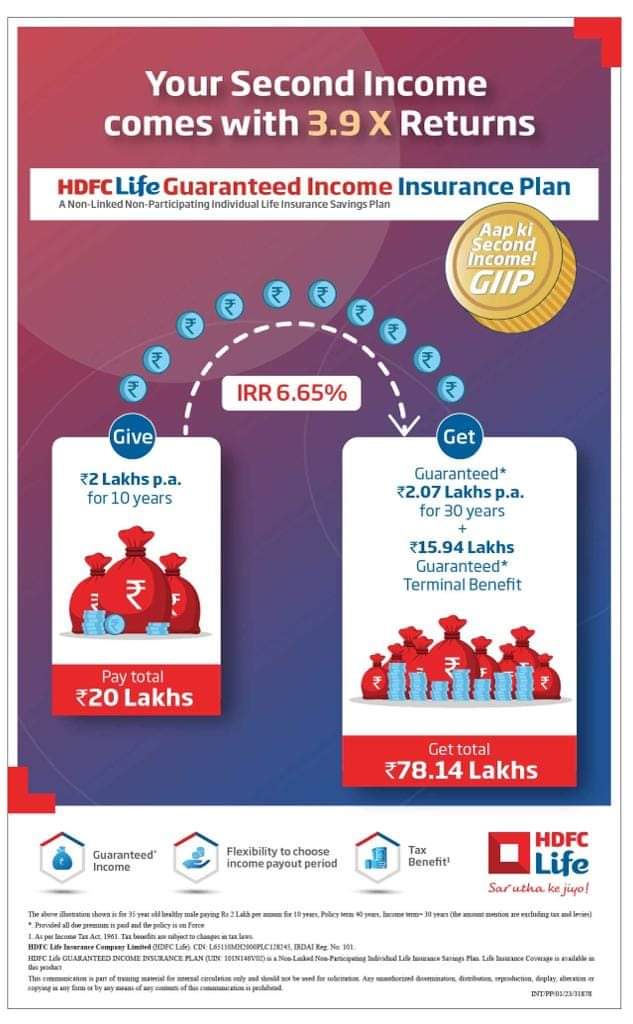

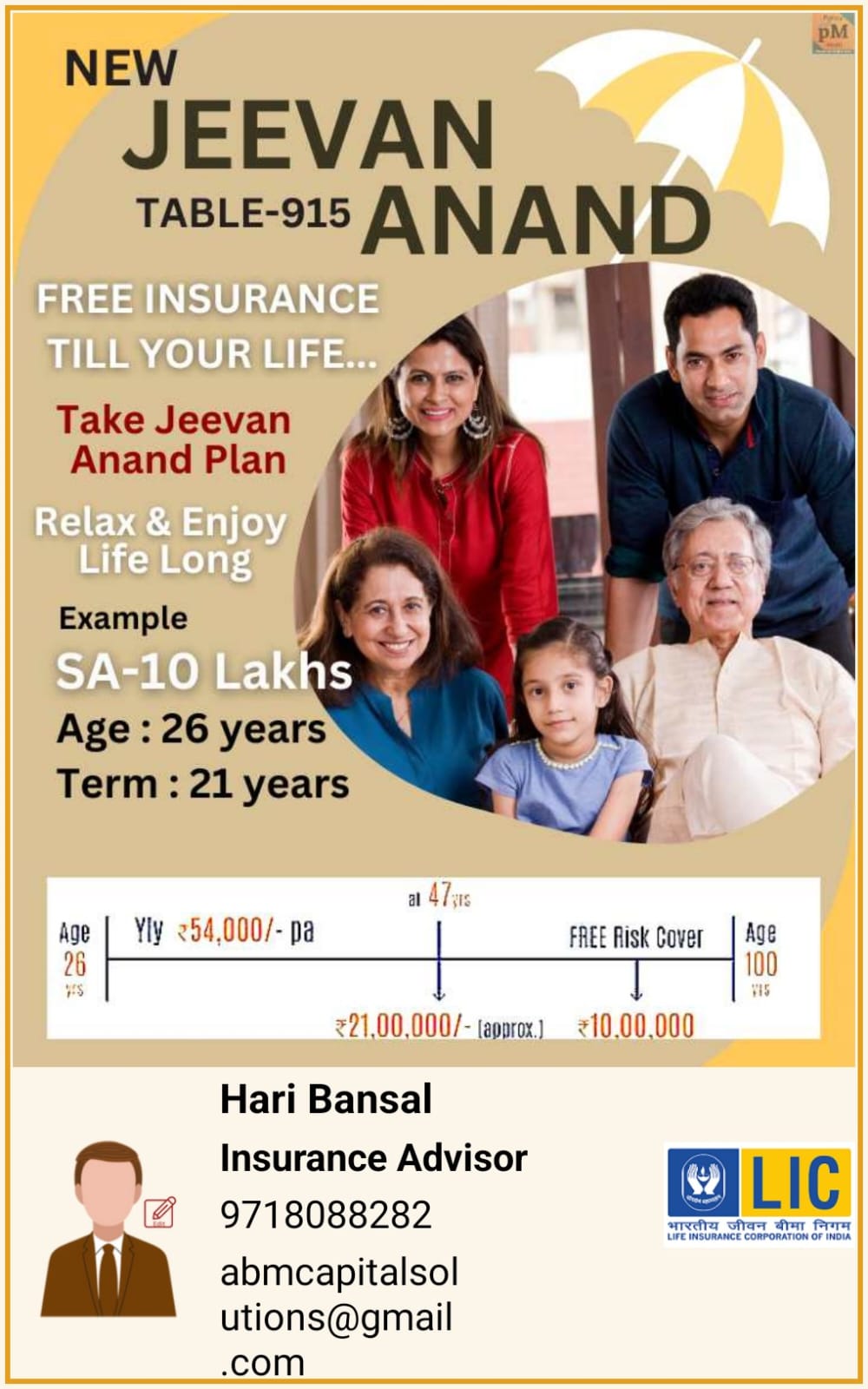

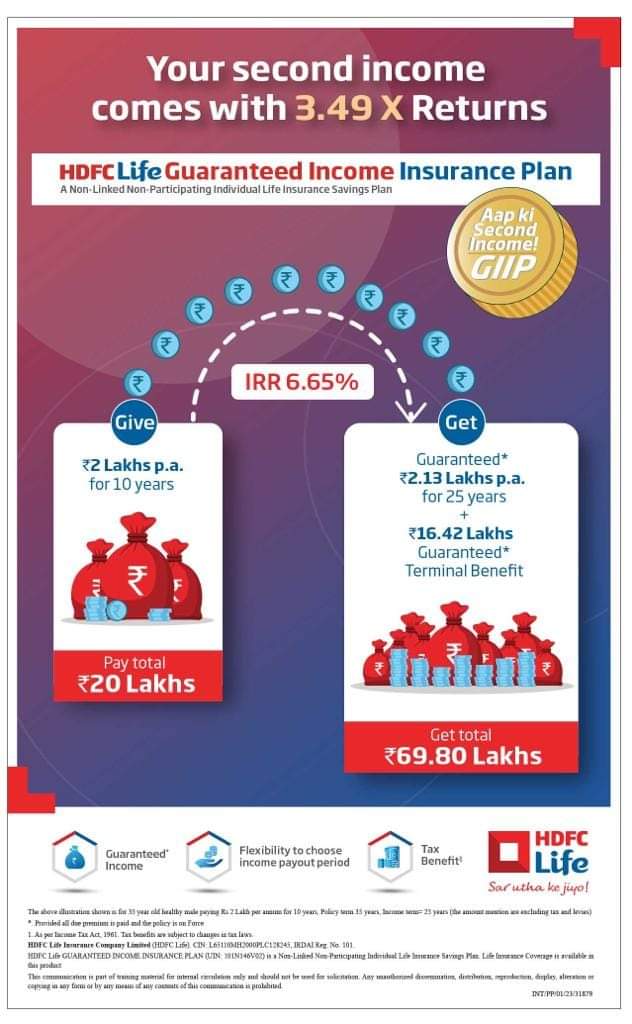

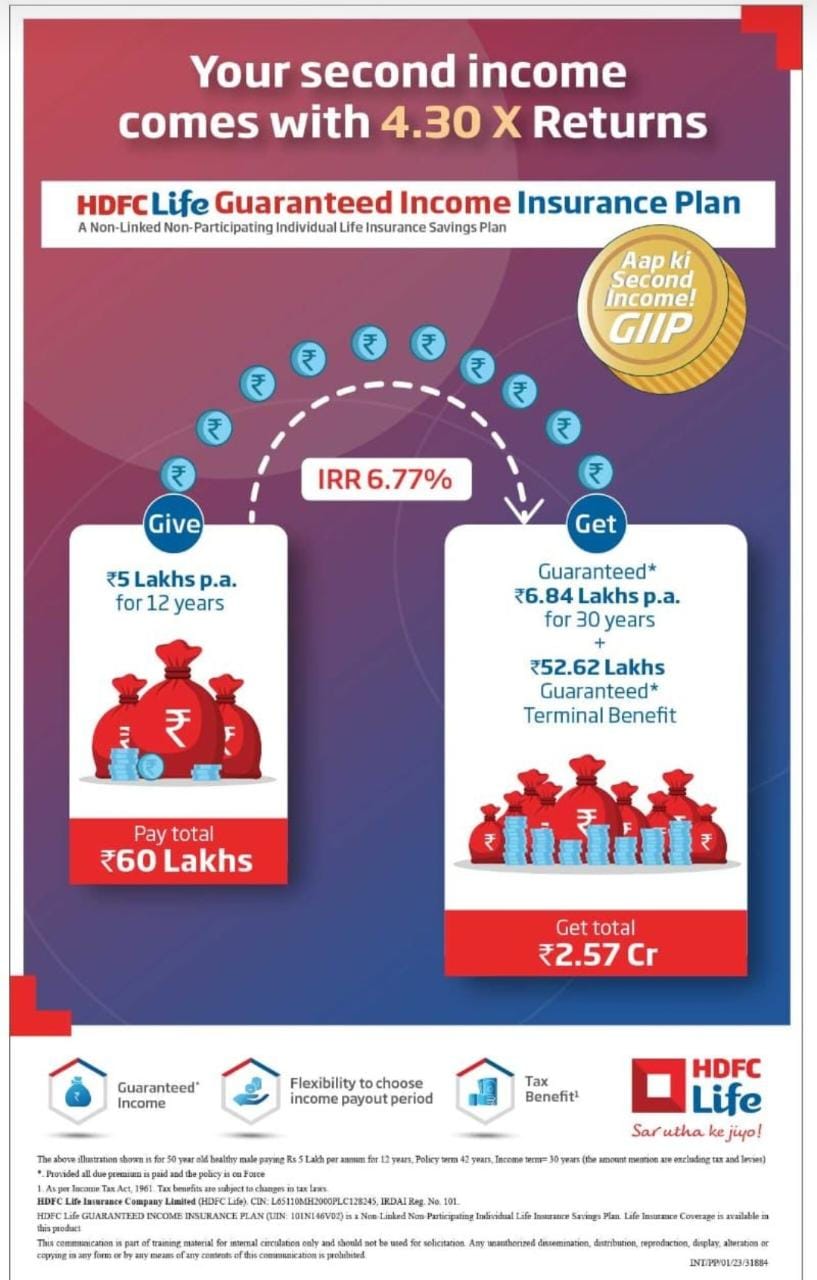

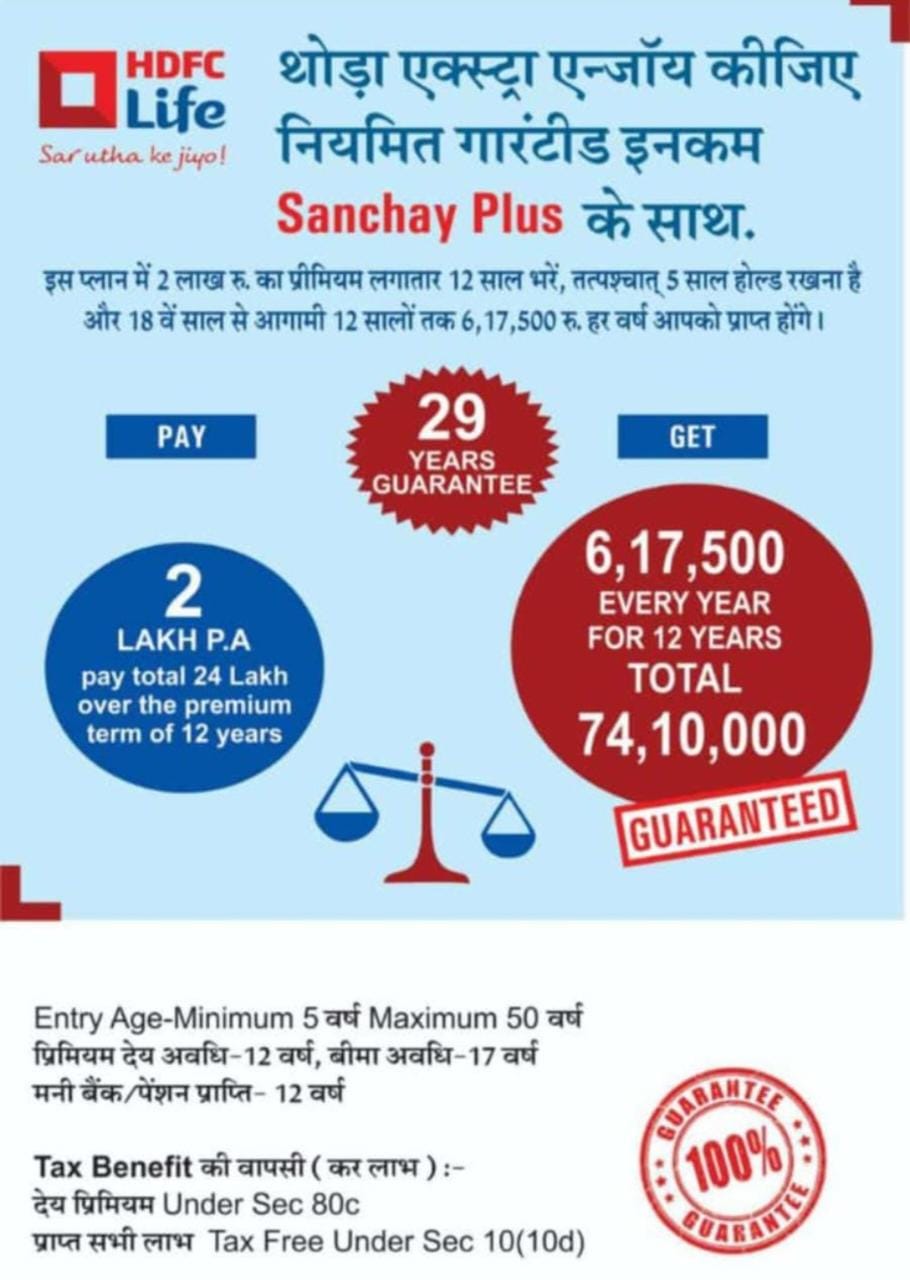

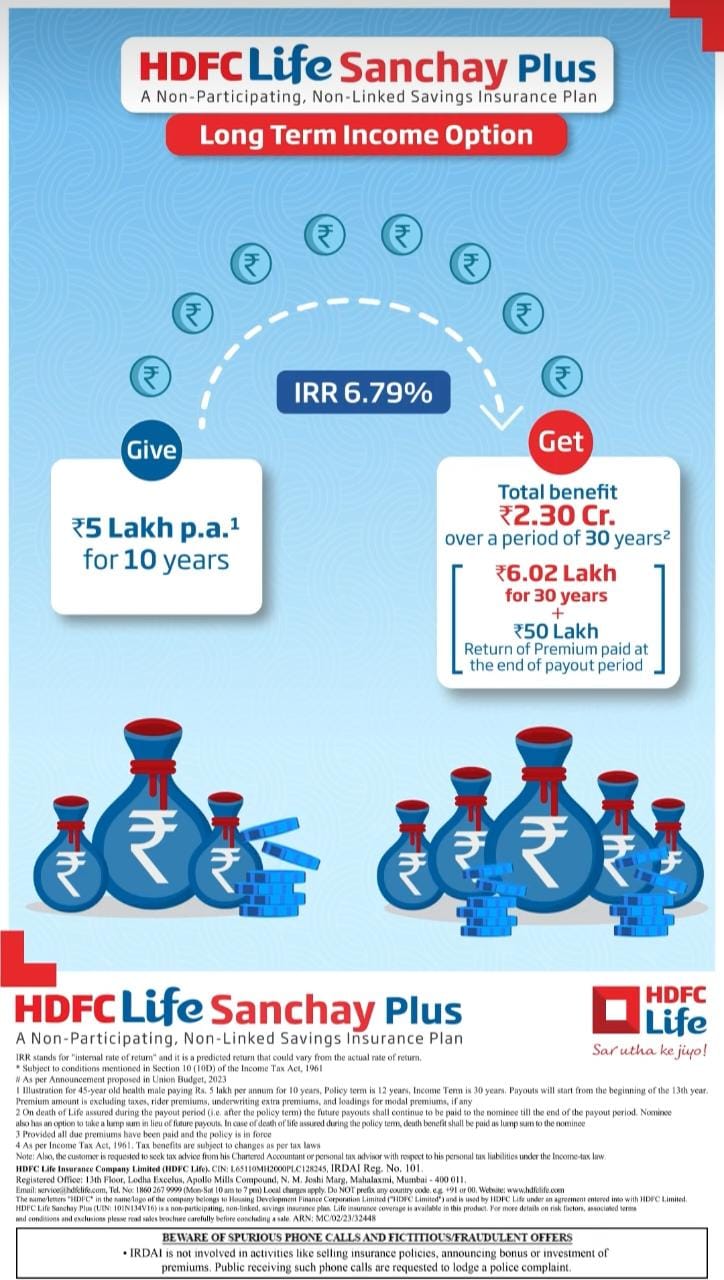

Endowment Plan

The endowment plan refers to the life insurance policy that provides risk cover to the policyholder under a maturity benefit or unfortunate event at the end of the policy term.

Types

-

Full or With Profit Endowment Plan - Here the sum assured is similar to the death benefit and is given to the policyholder at the end of the policy.

-

Guaranteed Endowment Plan - The policyholder can get guaranteed benefits under this plan to the sum assured amount and an additional bonus at the end of the policy.

-

Low-cost Endowment Plan - It can be made to help policyholders collect funds under a certain time that are paid out during the policy end as maturity.

-

Non-profit Endowment Plan - The sum assured can be paid out to the beneficiary or policyholder as a death or maturity benefit, and there won't be any additional bonus.

Benefits

- Maturity Value - You can still receive the amount even if you survive your policy term. It is more than the protection plan.

- Financial Cover - If you die at the policy term, your family can get the sum assured. It includes the death benefit amount.

- Tax Exemption - You can save more on taxes through this endowment plan.

- Addition of Riders - You can improve your sum assured and cover situations that your base policy doesn't.

Documents Required:

Prospective policyholders will need to comply with Know Your Customer (KYC) guidelines before availing of the saving scheme. Below are some of the documents required for buying the saving policy.

- Permanent Account Number (PAN) or Form No. 60

- Address Proof

- Age Proof

- Photograph

- Voter's Identity Card issued by the Election Commission of India

What Is Not Included?

The insured needs to check what the policy does not cover before buying them. Below are some of the typical claims excluded by insurance companies.

- Death by accident due to alcohol usage.

- Death due to drugs usage.

- Death due to committing suicide.

- Death due to dangerous sports like racing.