Health Insurance

Health Insurance is a type of General Insurance that protects you from your financial losses due to a disease or any other medical illness. It makes you strong financially and also mentally in case of medical emergencies.

Here are various types of Health Insurance Plans depending upon the level of coverage required. Most of the plans cover pre-hospitalization and post-hospitalization, critical illness, maternity expenses, and annual health check-ups. While some plans also cover preventive care like vaccinations and regular health check-ups.

The cost of Health Insurance depends upon various factors like the level of coverage, age of the person, number of persons, current health status, and location.

Health Insurance Types

-

Free of Service Plans – In this, the insurance company reimburses your medical expenses.

-

Short-Term Health Insurance Plans – These plans provide coverage for a maximum of 12 months.

-

Health Maintenance Organisations (HMO) – One Primary Care Physician is selected who acts as approval authority for all your visits to specialists or other services.

-

Preferred Provider Organization (PPO) – Any one preferred healthcare provider is selected from the network. But if the insured is willing to pay the extra amount above the approved limit, he can also go to the service provider out of the network.

-

Catastrophic Health Insurance Plans – These plans cover serious illness or injuries.

-

Point of Service Plans (POS) – Combination of PPO and HMO Plan. You can choose the provider from the network or you may also go to a provider outside the network.

Benefits of Health Insurance

There are several benefits of having general insurance:

-

You can find many insurance plans at very reasonable premiums.

-

It gives financial protection against uncertain medical expenses arising because of an accident or medical emergency.

-

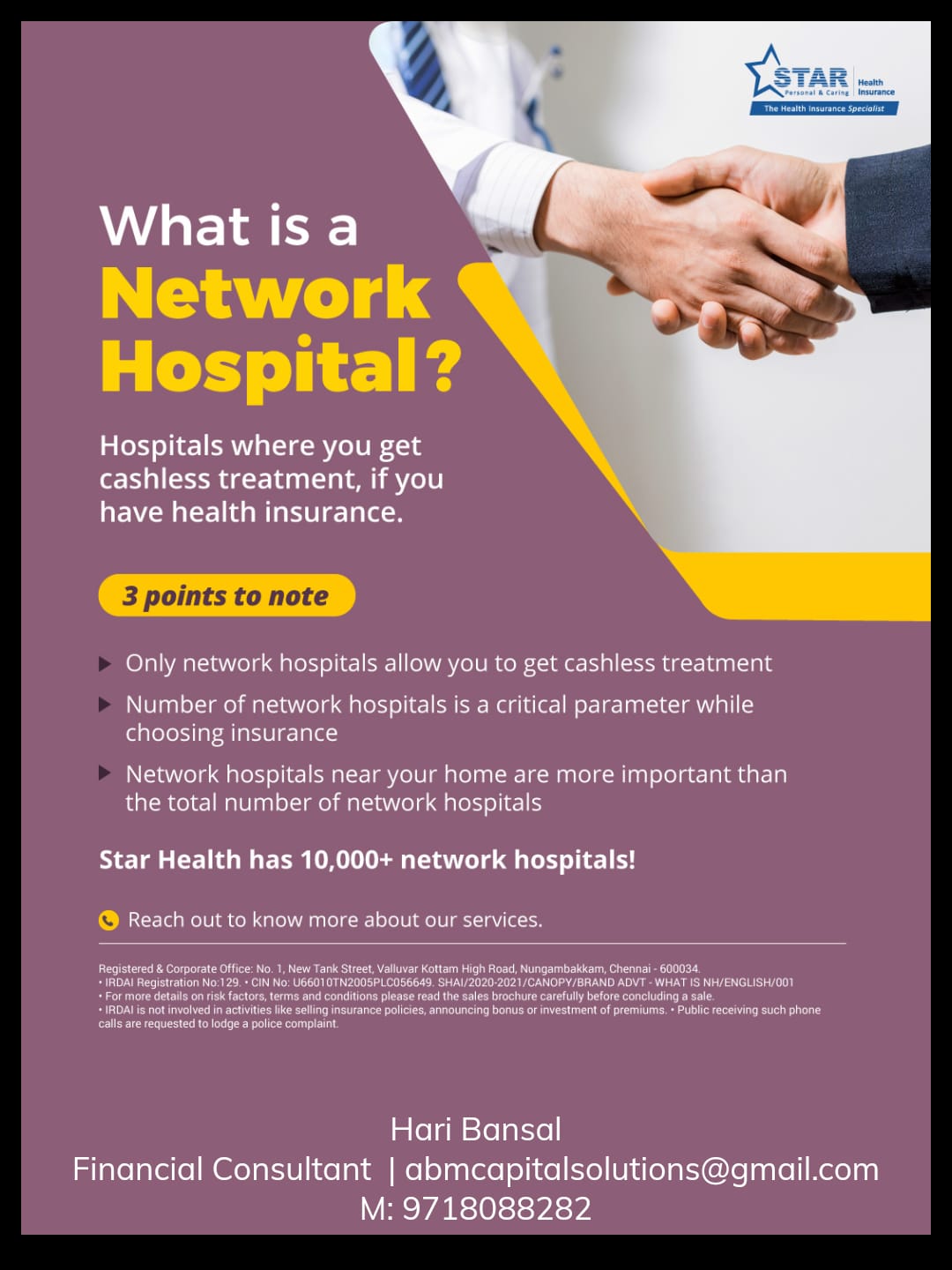

It enables you to access a better range of various super specialty medical centers or hospitals

-

Some health insurance plan gives you coverage for preexisting diseases also.

-

Many Family insurance plans are also available, thus giving financial support to your entire family also. The family includes your parents, spouse, and children.

-

In many countries it is compulsory by law to have medical insurance.

-

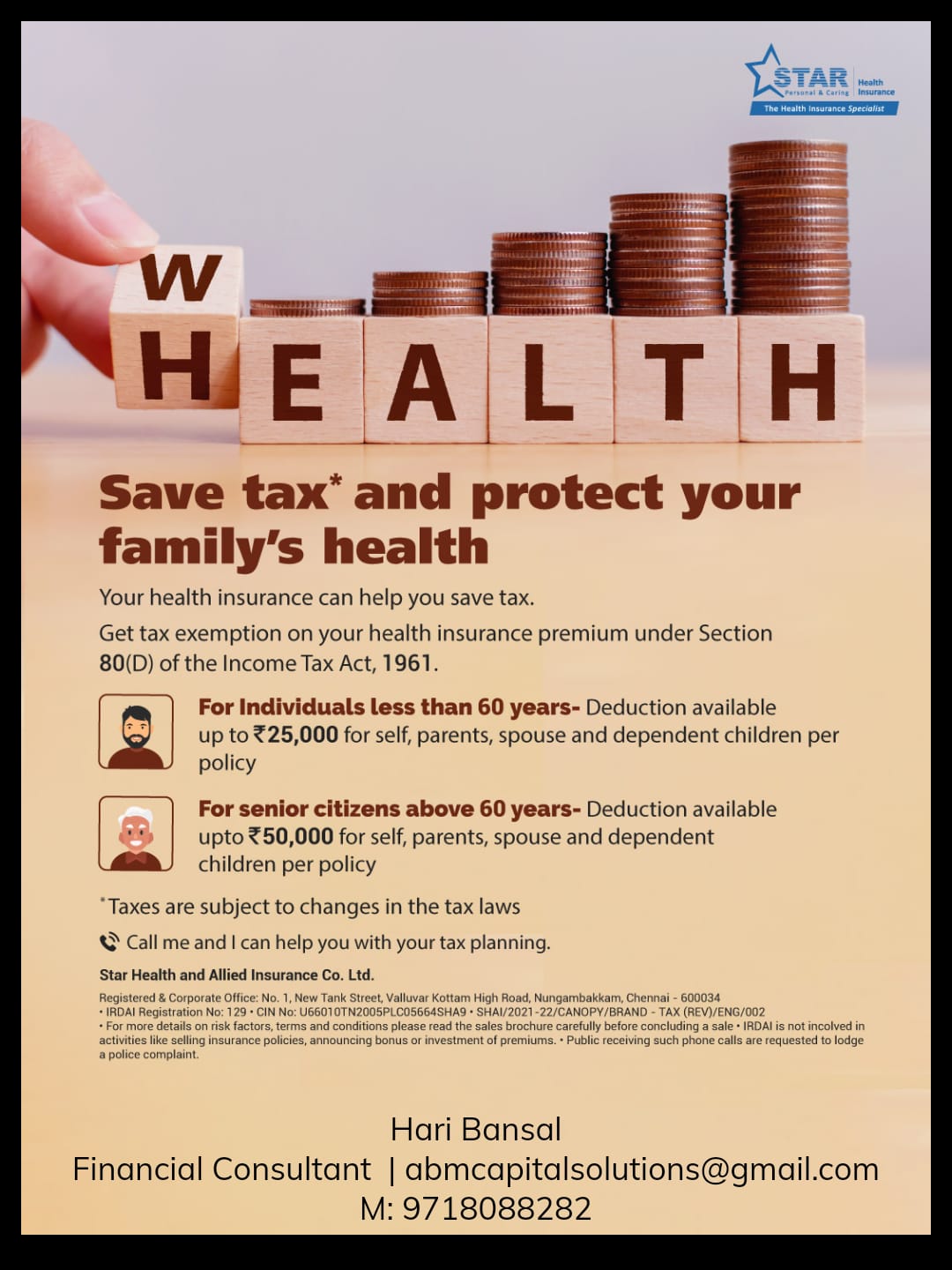

You get the tax deduction on the premium paid.

-

Having health insurance gives you peace of mind as you are already prepared for unforeseen health issues. You are eligible for cashless treatment in the hour of your need.

What is not covered in Health Insurance :

-

Pre-natal and Post-Natal expenses.

-

Pre-existing diseases.

-

Hospitalization without Doctor’s prescription except emergencies.

Documents Required

-

Identification proof like Passport/ Driving License/Any Other Government-issued document.

-

Age Proof like Birth Certificate/Passport/ Any Other Government-issued document.

-

Address Proof like Utility Bills/Rent Agreement/Any Other Government-issued document.

-

Medical History of Previous Ailments.

-

Income Proof like Salary Slips/Bank Statements/Income Tax Return

-

Family Details like Name, Age, Medical history

-

Application Form

.png)